Question: QUESTION 5 The difference between Scenario Analysis and Sensitivity Analysis, with respect to the NPV of a Capital Budgeting Project is: a. For all practical

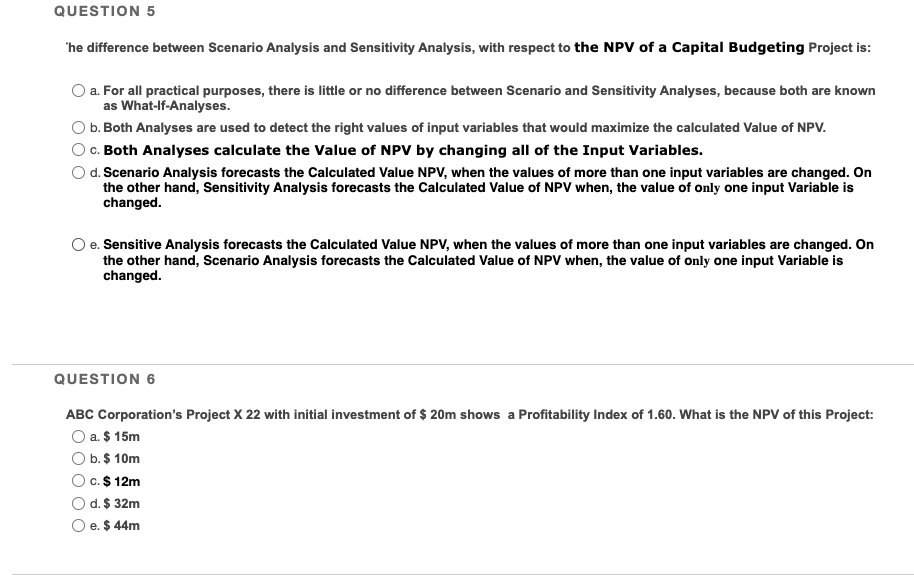

QUESTION 5 The difference between Scenario Analysis and Sensitivity Analysis, with respect to the NPV of a Capital Budgeting Project is: a. For all practical purposes, there is little or no difference between Scenario and Sensitivity Analyses, because both are known as What-If-Analyses. Ob. Both Analyses are used to detect the right values of input variables that would maximize the calculated Value of NPV. c. Both Analyses calculate the value of NPV by changing all of the Input Variables. d. Scenario Analysis forecasts the Calculated Value NPV, when the values of more than one input variables are changed. On the other hand, Sensitivity Analysis forecasts the Calculated Value of NPV when, the value of only one input Variable is changed. e. Sensitive Analysis forecasts the Calculated Value NPV, when the values of more than one input variables are changed. On the other hand, Scenario Analysis forecasts the Calculated Value of NPV when, the value of only one input Variable is changed. QUESTION 6 ABC Corporation's Project X 22 with initial investment of $ 20m shows a Profitability Index of 1.60. What is the NPV of this project: O a. $ 15m b. $ 10m c. $ 12m O d. $ 32m e. $ 44m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts