Question: QUESTION 7 The difference between scenario analysis and sensitivity analysis is scenario analysis considers the effect on net present value (NPV) of changing multiple project

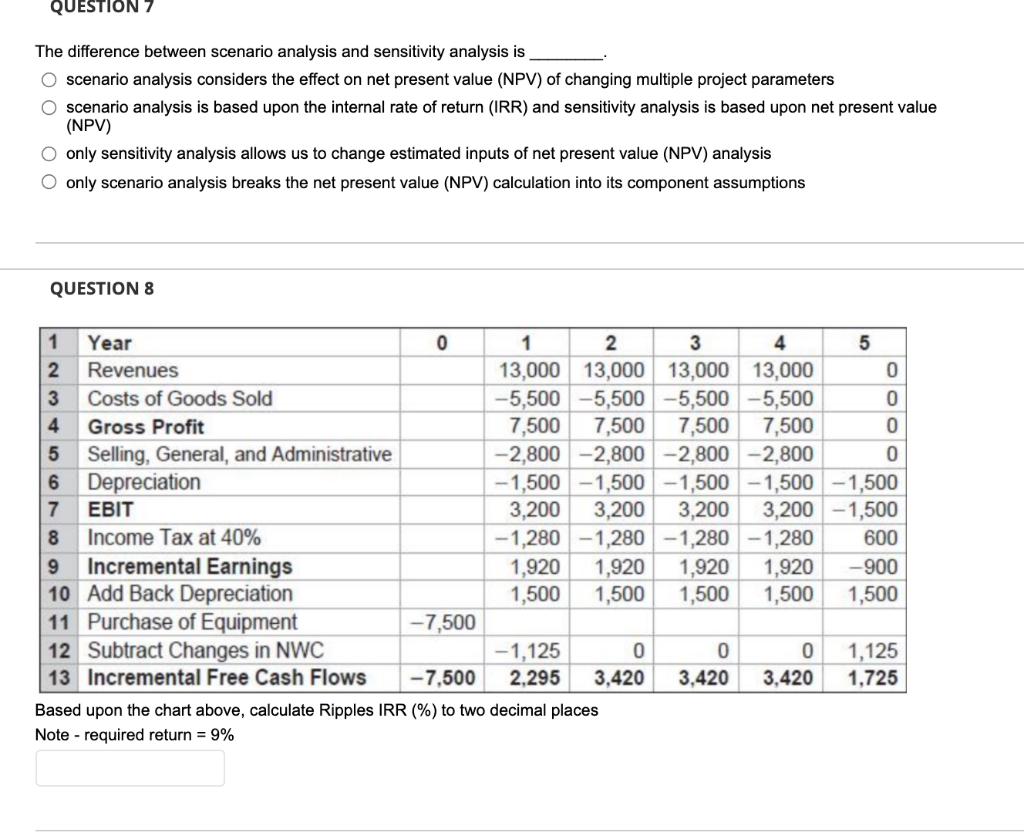

QUESTION 7 The difference between scenario analysis and sensitivity analysis is scenario analysis considers the effect on net present value (NPV) of changing multiple project parameters O scenario analysis is based upon the internal rate of return (IRR) and sensitivity analysis is based upon net present value (NPV) O only sensitivity analysis allows us to change estimated inputs of net present value (NPV) analysis O only scenario analysis breaks the net present value (NPV) calculation into its component assumptions QUESTION 8 2 N OOOO 1 Year 0 1 3 4 5 2 Revenues 13,000 13,000 13,000 13,000 3 Costs of Goods Sold -5,500 -5,500 -5,500 -5,500 4 Gross Profit 7,500 7,500 7,500 7,500 5 Selling, General, and Administrative -2,800 -2,800 -2,800 -2,800 6 Depreciation -1,500 -1,500 -1,500 - 1,500 - 1,500 7 EBIT 3,200 3,200 3,200 3,200 -1,500 8 Income Tax at 40% -1,280 -1,280 -1,280 -1,280 600 9 Incremental Earnings 1,920 1,920 1,920 1,920 -900 10 Add Back Depreciation 1,500 1,500 1,500 1,500 1,500 11 Purchase of Equipment -7,500 12 Subtract Changes in NWC -1,125 0 0 0 1,125 13 Incremental Free Cash Flows -7.500 2.295 3,420 3,420 3,420 1,725 Based upon the chart above, calculate Ripples IRR (%) to two decimal places Note - required return = 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts