Question: Question 5: The Markowitz portfolio selection model suggests that a security selection should achieve the best risk-return combinations. Using the information on the table below,

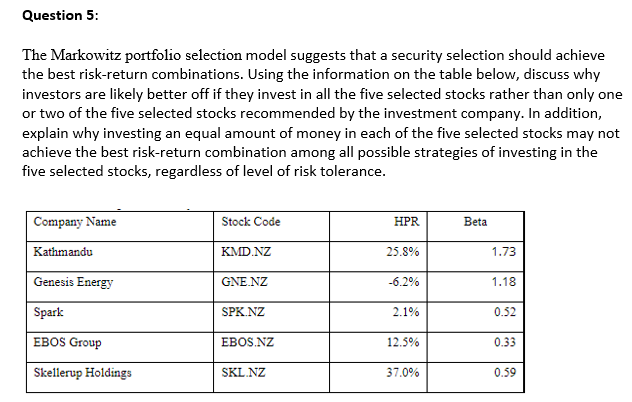

Question 5: The Markowitz portfolio selection model suggests that a security selection should achieve the best risk-return combinations. Using the information on the table below, discuss why investors are likely better off if they invest in all the five selected stocks rather than only one or two of the five selected stocks recommended by the investment company. In addition, explain why investing an equal amount of money in each of the five selected stocks may not achieve the best risk-return combination among all possible strategies of investing in the five selected stocks, regardless of level of risk tolerance. Company Name Stock Code HPR Beta Kathmandu KMD.NZ 25.8% 1.73 Genesis Energy GNE.NZ -6.2% 1.18 Spark SPK.NZ 2.1% 0.52 EBOS Group EBOS.NZ 12.5% 0.33 Skellerup Holdings SKL.NZ 37.0% 0.59 Question 5: The Markowitz portfolio selection model suggests that a security selection should achieve the best risk-return combinations. Using the information on the table below, discuss why investors are likely better off if they invest in all the five selected stocks rather than only one or two of the five selected stocks recommended by the investment company. In addition, explain why investing an equal amount of money in each of the five selected stocks may not achieve the best risk-return combination among all possible strategies of investing in the five selected stocks, regardless of level of risk tolerance. Company Name Stock Code HPR Beta Kathmandu KMD.NZ 25.8% 1.73 Genesis Energy GNE.NZ -6.2% 1.18 Spark SPK.NZ 2.1% 0.52 EBOS Group EBOS.NZ 12.5% 0.33 Skellerup Holdings SKL.NZ 37.0% 0.59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts