Question: QUESTION 5 - This question has 2 parts (a), and (b). James was born in February 1966 and is currently 57 years old. He plans

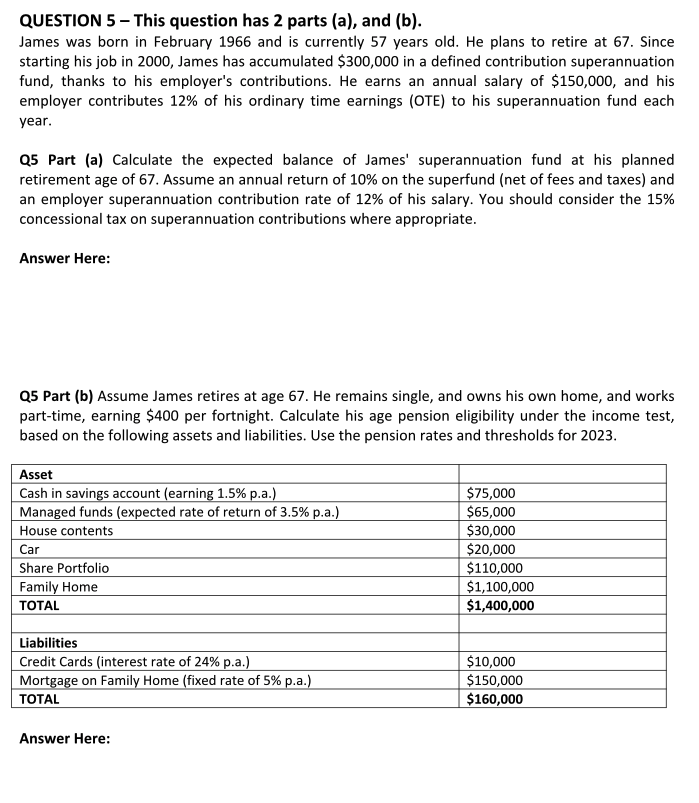

QUESTION 5 - This question has 2 parts (a), and (b). James was born in February 1966 and is currently 57 years old. He plans to retire at 67. Since starting his job in 2000 , James has accumulated $300,000 in a defined contribution superannuation fund, thanks to his employer's contributions. He earns an annual salary of $150,000, and his employer contributes 12% of his ordinary time earnings (OTE) to his superannuation fund each year. Q5 Part (a) Calculate the expected balance of James' superannuation fund at his planned retirement age of 67 . Assume an annual return of 10% on the superfund (net of fees and taxes) and an employer superannuation contribution rate of 12% of his salary. You should consider the 15% concessional tax on superannuation contributions where appropriate. Answer Here: Q5 Part (b) Assume James retires at age 67. He remains single, and owns his own home, and works part-time, earning $400 per fortnight. Calculate his age pension eligibility under the income test, based on the following assets and liabilities. Use the pension rates and thresholds for 2023. Answer Here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts