Question: QUESTION 5 - This question has 2 parts (a), and (b). James was born in February 1966 and is currently 57 years old. He plans

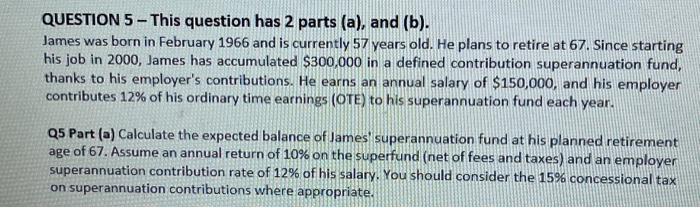

QUESTION 5 - This question has 2 parts (a), and (b). James was born in February 1966 and is currently 57 years old. He plans to retire at 67 . Since starting his job in 2000 , James has accumulated $300,000 in a defined contribution superannuation fund, thanks to his employer's contributions. He earns an annual salary of $150,000, and his employer contributes 12% of his ordinary time earnings (OTE) to his superannuation fund each year. Q5 Part (a) Calculate the expected balance of James' superannuation fund at his planned retirement age of 67 . Assume an annual return of 10% on the superfund (net of fees and taxes) and an employer superannuation contribution rate of 12% of his salary. You should consider the 15% concessional tax on superannuation contributions where appropriate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts