Question: QUESTION 5 Total 13 marks A financial institution will pay its creditor $20,000 at the beginning of each year for a 4-year period. The first

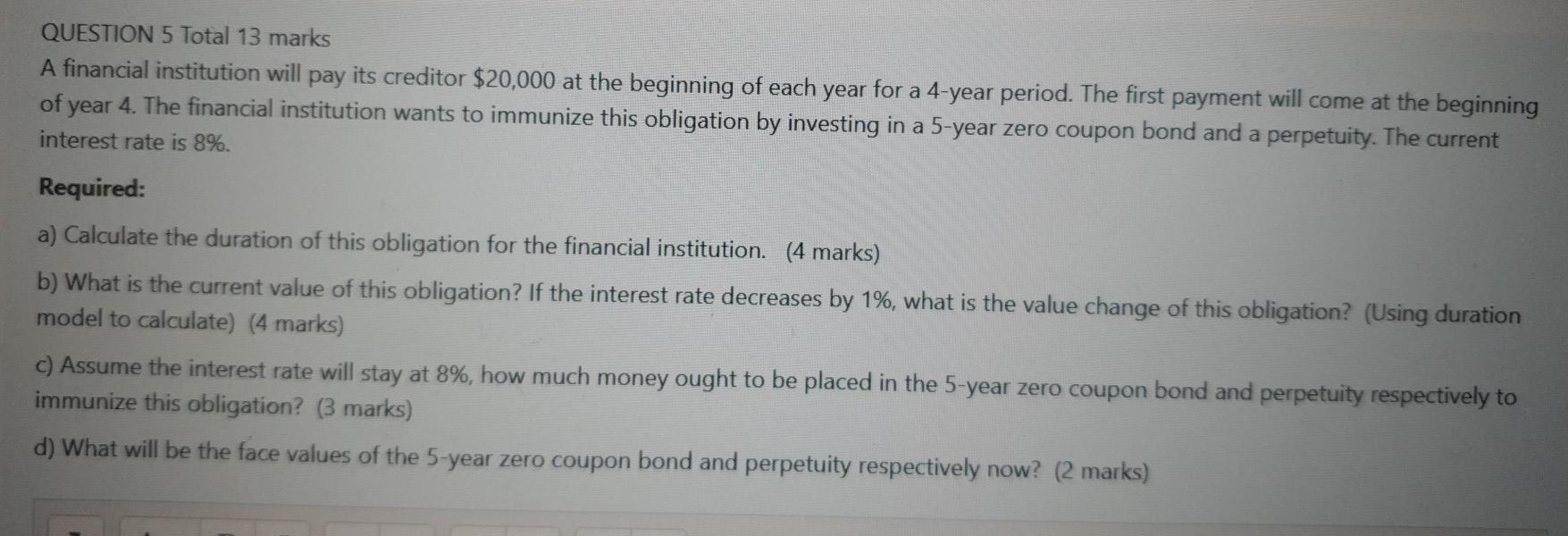

QUESTION 5 Total 13 marks A financial institution will pay its creditor $20,000 at the beginning of each year for a 4-year period. The first payment will come at the beginning of year 4. The financial institution wants to immunize this obligation by investing in a 5-year zero coupon bond and a perpetuity. The current interest rate is 8%. Required: a) Calculate the duration of this obligation for the financial institution. (4 marks) b) What is the current value of this obligation? If the interest rate decreases by 1%, what is the value change of this obligation? (Using duration model to calculate) (4 marks) c) Assume the interest rate will stay at 8%, how much money ought to be placed in the 5-year zero coupon bond and perpetuity respectively to immunize this obligation? (3 marks) d) What will be the face values of the 5-year zero coupon bond and perpetuity respectively now? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts