Question: QUESTION 5 [TOTAL MARKS: 25] Q 5(a) [19 Marks] The following is an extract from the balance sheet of Caval plc: Ordinary shares of 50c

![QUESTION 5 [TOTAL MARKS: 25] Q 5(a) [19 Marks] The following](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67038c0e6fcb5_70967038c0ddc5e0.jpg)

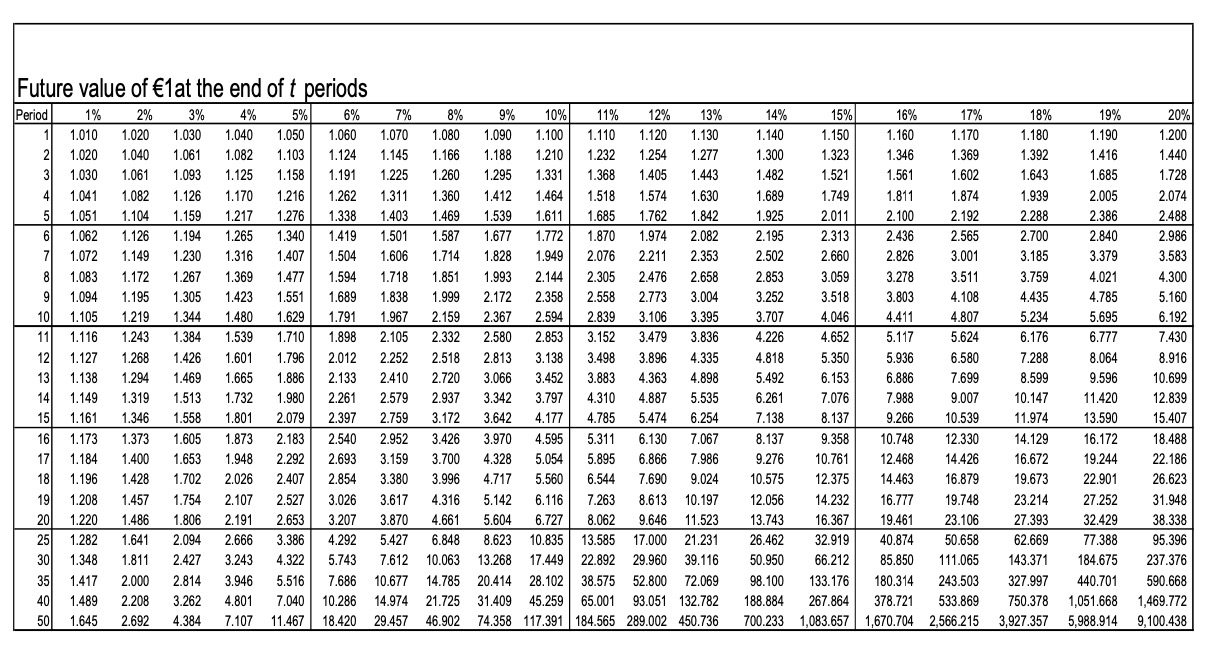

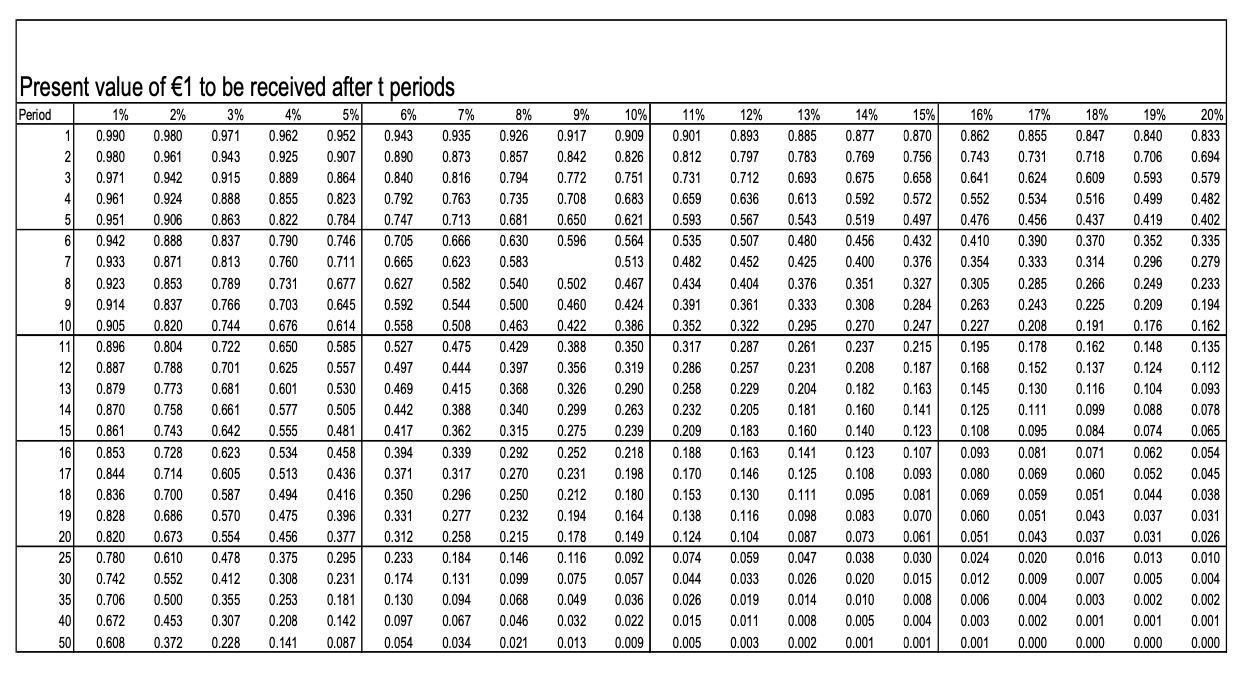

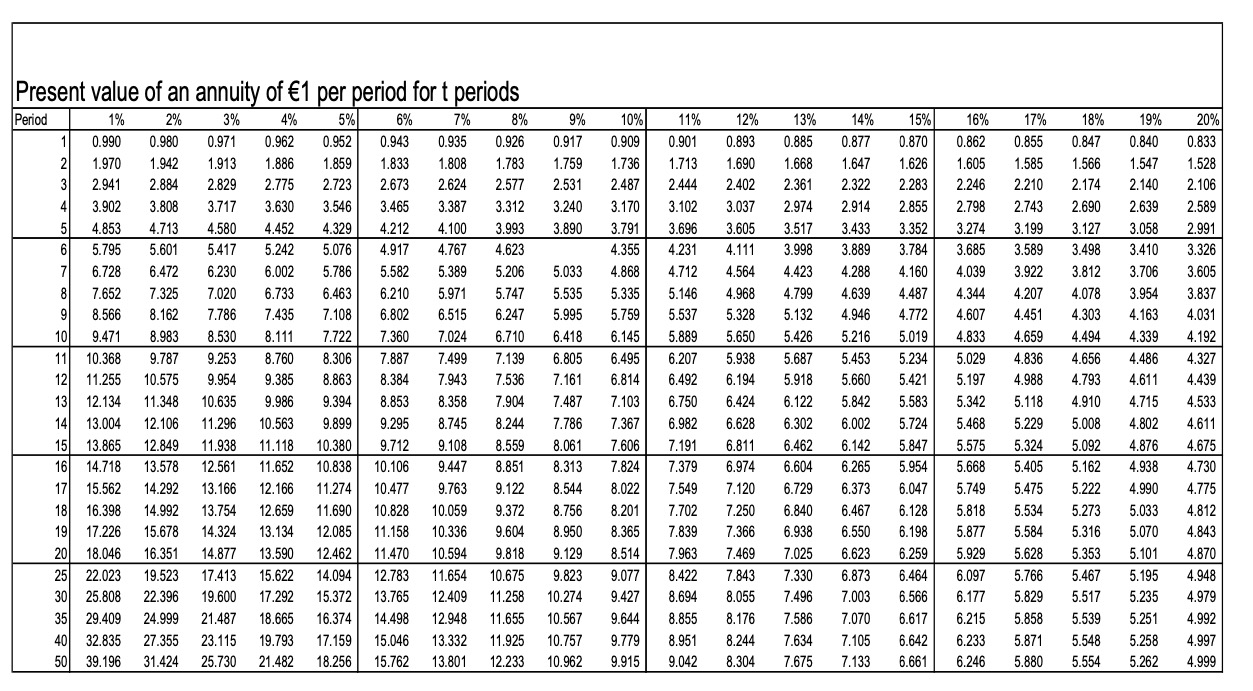

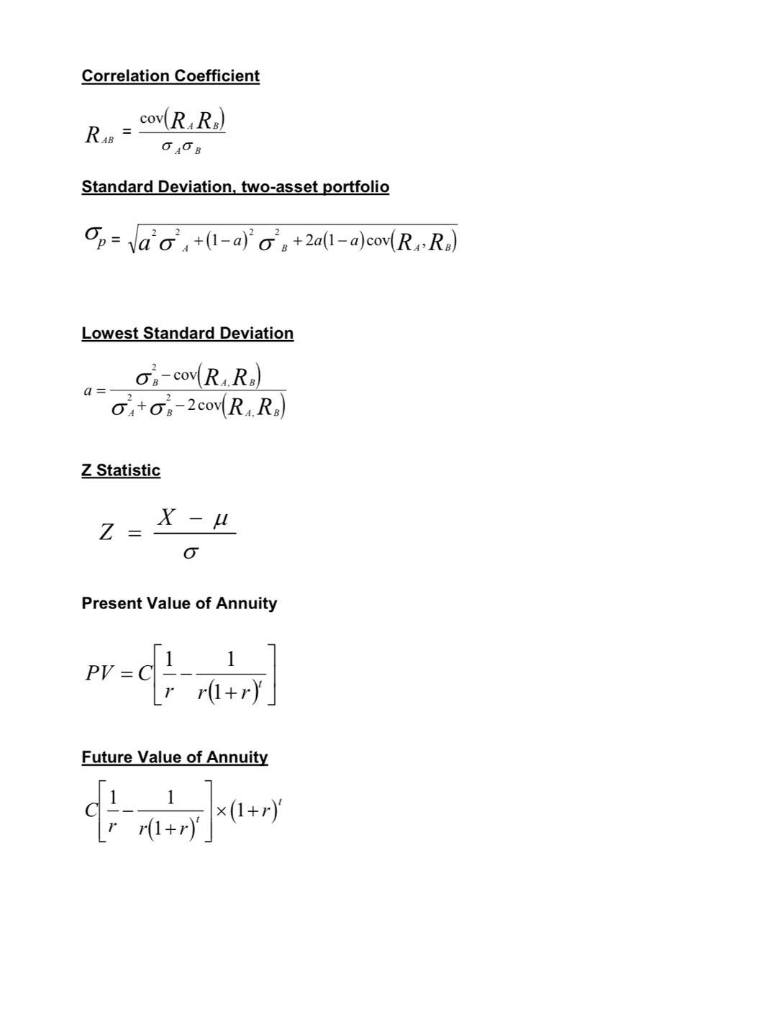

QUESTION 5 [TOTAL MARKS: 25] Q 5(a) [19 Marks] The following is an extract from the balance sheet of Caval plc: Ordinary shares of 50c each Reserves 9% preference shares of 1 each 14% debentures Bank loan Total long-term funds 000 5,200 4,850 4,500 5.000 6,500 26,050 The ordinary shares are quoted at 80c. The dividend just paid was 4c and will grow thereafter at 10% per annum indefinitely. The preference shares are quoted at 63c, and the debentures are quoted at 94 per 100. Corporation tax is 13%. The cost of the bank loan is 8.5%. Required: Calculate the weighted average cost (WACC) of the company. Q 5(b) [2 marks] Why are retained profits not considered to be a free source of finance? Q 5(c) [2 marks] Define capital gearing and what is meant by, a highly geared company? Q 5(d) [2 marks] Why can we not always take the coupon rate on a bond issued years ago as the cost of bond finance? [End of Question5] covouw 19% 1.190 1.416 1.685 2.005 2.386 2.840 3.379 4.021 Future value of 1at the end of t periods Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1.010 1.020 1.030 1.040 1.050 1.060 1.070 1.080 1.090 1.100 1.020 1.040 1.061 1.082 1.103 1.124 1.145 1.166 1.188 1.210 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.260 1.295 1.331 1.041 1.082 1.126 1.170 1.216 1.2621.311 1.360 1.4121.464 1.051 1.104 1.159 1.217 1.276 1.338 1.403 1.469 1.539 1.611 1.062 1.126 1.194 1.265 1.340 1.419 1.501 1.587 1.677 1.772 1.072 1.149 1.230 1.316 1.407 1.504 1.606 1.714 1.828 1.949 8 1.083 1.1721.267 1.369 1.477 1.594 1.718 1.851 1.993 2.144 1.094 1.195 1.305 1.423 1.551 1.689 1.838 1.999 2.172 2.358 101 1.105 1.219 1.344 1.480 1.629 1.791 1.967 2.159 2.367 2.594 1.116 1.243 1.384 1.539 1.710 1.898 2.105 2.332 2.580 2.853 12 1.127 1.268 1.426 1.601 1.796 2.012 2.252 2.518 2.813 3.138 131 1.138 1.294 1.469 1.665 1.886 2.133 2.410 2.720 3.066 3.452 14 1.149 1.319 1.513 1.732 1.980 2.261 2.579 2.937 3.342 3.797 1.161 1.346 1.558 1.801 2.079 2.397 2.759 3.172 3.642 4.177 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 3.970 4.595 1.184 1.400 1.653 1.948 2.292 3.1593.700 4.328 5.054 181 1.196 1.428 1.702 2.026 2.407 2.854 3.380 3.996 4.717 5.560 19 1.208 1.4571.754 2.107 2.527 3.026 3.617 4.316 5.1426.116 1.220 1.486 1.806 2.191 2.653 3.207 3.870 4.6615.604 6.727 1.282 1.641 2.094 2.666 3.386 4.292 5.427 6.848 8.623 10.835 1.348 1.811 2.427 3.243 4.322 5.743 7.612 10.063 13.268 17.449 35 1.417 2.000 2.814 3.946 5.516 7.686 10.677 14.785 20.414 28.102 40 1.489 2.208 3.262 4.801 7.040 10.286 14.974 21.725 31.409 45.259 50 1.645 2.692 4.384 7.107 11.467 18.420 29.457 46.902 74.358 117.391 4.785 11% 12% 13% 1.110 1.120 1.130 1.232 1.254 1.277 1.443 1.518 1.574 1.630 1.685 1.762 1.842 1.870 1.974 2.082 2.076 2.211 2.353 2.305 2.476 2.658 2.558 2.7733.004 2.839 3.106 3.395 3.152 3.479 3.836 3.498 3.896 4.335 3.883 4.363 4.898 4.310 4.887 5.535 4.785 5.474 6.254 5.311 6.130 7.067 5.895 6.866 7.986 6.544 7.690 9.024 7.263 8.613 10.197 8.062 9.646 11.523 13.585 17.000 21.231 22.892 29.960 39.116 38.575 52.800 72.069 65.001 93.051 132.782 184.565 289.002 450.736 15% 1.150 1.323 1.521 1.749 2.011 2.313 2.660 3.059 3.518 4.046 4.652 5.350 6.153 7.076 14% 1.140 1.300 1.482 1.689 1.925 2.195 2.502 2.853 3.252 3.707 4.226 4.818 5.492 6.261 7.138 8.137 9.276 10.575 12.056 13.743 26.462 50.950 98.100 188.884 700.233 16% 1.160 1.346 1.561 1.811 2.100 2.436 2.826 3.278 3.803 4.411 5.117 5.936 6.886 7.988 9.266 10.748 12.468 14.463 16.777 19.461 40.874 85.850 180.314 378.721 1,670.704 17% 18% 1.170 1.180 1.369 1.392 1.602 1.643 1.874 1.939 2.192 2.288 2.565 2.700 3.001 3.185 3.511 3.759 4.108 4.435 4.807 5.234 5.624 6.176 6.580 7.288 7.699 8.599 9.007 10.147 10.539 11.974 12.330 14.129 14.426 16.672 16.879 19.673 19.748 23.214 23.106 27.393 50.658 62.669 111.065 143.371 243.503 327.997 533.869 750.378 2,566.2153,927.357 1.200 1.440 1.728 2.074 2.488 2.986 3.583 4.300 5.160 6.192 7.430 8.916 10.699 12.839 15.407 18.488 22.186 26.623 31.948 38.338 95.396 237.376 590.668 1,469.772 9,100.438 8.137 5.695 6.777 8.064 9.596 11.420 13.590 16.172 19.244 22.901 27.252 32.429 77.388 184.675 440.701 1,051.668 5,988.914 9.358 10.761 12.375 14.232 16.367 32.919 66.212 133.176 267.864 1,083.657 0 0 9% 0.917 0.842 0.772 0.708 0.650 0.596 0 olu 0 0 Present value of 1 to be received after t periods Period 1% 2% 3% 4% 5% 6% 7% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.923 0.853 0.789 0.731 0.677 0.627 0.582 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 101 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.896 0.804 0.722 0.650 0.585 0.527 0.475 121 0.887 0.788 0.701 0.625 0.557 0.497 0.444 131 0.879 0.773 0.681 0.601 0.530 0.469 0.415 141 0.870 0.758 0.661 0.577 0.505 0.442 0.388 151 0.861 0.743 0.642 0.556 0.481 0.417 0.362 161 0.853 0.728 0.623 0.534 0.458 0.394 0.339 171 0.844 0.714 0.605 0.513 0.436 0.371 0.317 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 2010.820 0.673 0.554 0.456 0.377 0.312 0.258 25 0.780 0.610 0.478 0.375 0.295 0.233 0.184 30 0.742 0.5520.412 0.308 0.231 0.174 0.131 351 0.706 0.500 0.355 0.253 0.181 0.130 0.094 401 0.672 0.453 0.307 0.208 0.142 0.097 0.067 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0 .540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.146 0.099 0.068 0.046 0.021 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.092 0.057 0.036 0.022 0.009 11% .901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0.026 0.015 0.005 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.059 0.033 0.019 0.011 0.003 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.116 0.075 0.049 0.032 0.013 13% 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 .125 0.111 0.098 0.087 0.047 0.026 0.014 0.008 0.002 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 .182 .160 0.140 0.123 0.108 .095 0.083 0.073 0.038 0.020 0.010 0.005 .001 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.093 0.081 0.070 0.061 0.030 0.015 0.008 0.004 0.001 16% 17% 18% 0.862 0.855 0.847 0.743 0.731 0.718 0.641 0 .624 0.609 0.552 0.534 0.516 0.476 0.456 0.437 0.410 0.390 0.370 0.354 0.333 0.314 0.305 0.285 0.266 0.263 0.243 0.225 0.227 0.208 0.191 0.195 0.178 0.162 0.168 0.152 0.137 0.145 0.130 0.116 0.125 0.111 0.099 0.108 0.095 0.084 0.093 0.081 0.071 0.080 0.069 0.060 0.069 0.059 0.051 0.060 0.051 0.043 0.051 0.043 0.037 0.024 0.020 0.016 0.0120.0090.007 0.006 0.004 0.003 0.003 0.002 0.001 0.001 0.000 0.000 0 0 19% .840 0.706 0.593 .499 0.419 0.352 0.296 0.249 0.209 .176 0.148 .124 .104 0.088 .074 0.062 0.052 .044 0.037 0.031 .013 0.005 0.002 0.001 0.000 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 .233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.010 0.004 0.002 0.001 0.000 0 0 0 0 0 0 APPENDICES Formulae NPV = C. + ( ) for IRR = LDR +_ LRNPV Npy *(HDR LDR) ARR = Average Annual Profit *100 Average Capital Invested CAPM = K = KRE+B(K.- KRP) Gordon's Growth Model Div, P =- r-g Standard Deviation o= (R-R) P Covariance cov(R.-R.) = (R.-R.)(R.-Ry) p} 1 Present value of an annuity of 1 per period fort periods Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 6 5.795 5.601 5.417 5.2425.076 4.917 4.767 4.623 4.355 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.7475.535 5.335 9 8.566 8.1627.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 10) 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 11 10.368 9.787 9.253 8 .760 8.306 7.887 7.499 7.139 6.805 6.495 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.1616.814 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8 .756 8 .201 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 2018.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.8239.077 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 35 29.409 24.999 21.487 18.665 16.374 14.498 12.948 11.655 10.567 9.644 401 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9 .779 50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 S88888sala e a waloon volonac 11% 12% 13% 14% 15% 0.901 0.893 0.885 0.877 0.870 .713 1.690 1.668 1.647 1.626 2.444 2.402 2 .361 2.322 2.283 3.102 3.037 2.974 2.914 2.855 3.696 3.605 3.517 3.433 3.352 4.231 4.111 3.998 3.8893.784 4.712 4.564 4.423 4.288 4.160 5.146 4.968 4.7994.6394.487 5.537 5.328 5.1324.946 4.772 5.889 5.650 5.426 5.216 5.019 6.207 5.938 5.687 5.453 5.234 6.4926.194 5.9185 .660 5.421 6.750 6.424 6.122 5 .842 5 .583 6.982 6.628 6.302 6 .002 5.724 7.191 6.811 6.462 6.142 5.847 7.379 6 .974 6.604 6.265 5.954 7.5497.120 6.7296.373 6.047 7.702 7.250 6.840 6.467 6.128 7.839 7 .366 6.938 6.550 6.198 7.963 7.469 7 .025 6.623 6.259 8.422 7.8437.3306.873 6.464 8.694 8.055 7.496 7.003 6.566 8.855 8.176 7.586 7.0706.617 8.951 8.244 7.634 7.105 6.642 9.042 8.304 7.675 7.133 6.661 | 16% 17% 18% 19% 20% 0.862 0.855 0.847 0.840 0.833 1.605 1.585 1.566 1.547 1.528 2.246 2.210 2.174 2.140 2.106 2.798 2.743 2.690 2.639 2.589 3.274 3.199 3 .127 3.058 2.991 3.685 3.589 3.498 3.410 3.326 4.039 3.922 3.8123.706 3.605 4.344 4.207 4.078 3.954 3.837 4.607 4.451 4.3034.163 4.031 4.833 4.659 4.494 4.339 4.192 5.029 4.836 4.656 4 .486 4.327 5.197 4.988 4.793 4.6114.439 5.342 5.118 4.9104 .715 4.533 5.468 5.229 5 .008 4.802 4.611 5.575 5.324 5.092 4.876 4.675 5.668 5.405 5.162 4 .938 4.730 5.749 5.475 5.222 4.990 4.775 5.818 5.534 5.273 5 .033 4.812 5.877 5.584 5.316 5 .070 4.843 5.929 5.628 5.353 5 .101 4.870 6.097 5.766 5.467 5.1954.948 6.1775.8295.517 5.235 4.979 6.215 5.858 5.5395.2514.992 6.233 5.871 5 .548 5.258 4.997 6.246 5.880 5.554 5.262 4.999 Correlation coefficient R = cov(R.R.) 003 Standard Deviation, two-asset portfolio A = a +(1-alo +2a(1-a)cos(RR) Lowest Standard Deviation o-cov( RR) oito-2 cov(R. R:) Z Statistic Z = X - 4 Present Value of Annuity Pv=cMoty Future Value of Annuity i 9 1_*(1+r)" r11+r)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts