Question: Question 5 When a riskless asset is available, there is a change in our contraints. Let wo be the weight on riskfree asset. Using wo=1

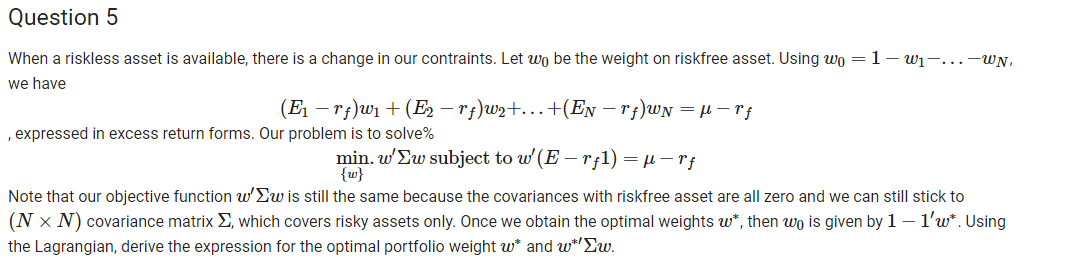

Question 5 When a riskless asset is available, there is a change in our contraints. Let wo be the weight on riskfree asset. Using wo=1 Wi-...-wn, we have (Ei - rf)wi + (E2 - rf)w2+...+(En -rf)wn = u-rf , expressed in excess return forms. Our problem is to solve% min. w'Ew subject to w'(E r:1) = urf {w} Note that our objective function w'Xw is still the same because the covariances with riskfree asset are all zero and we can still stick to (N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts