Question: Question 5: Your opinion is that a security has an expected rate of return of 10.6%. It has a beta of 1.2 . The risk-free

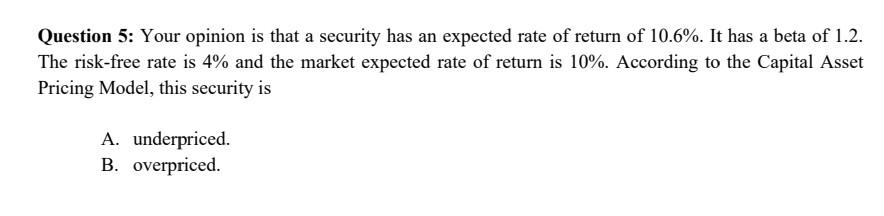

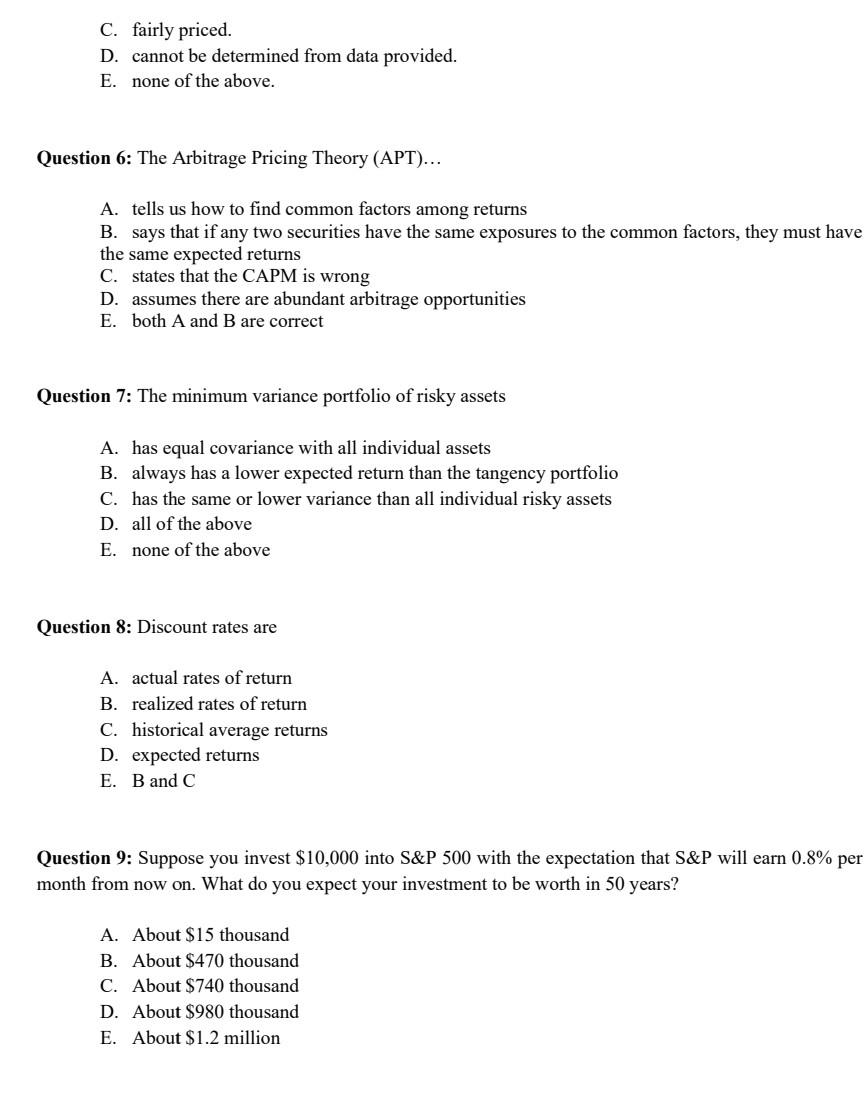

Question 5: Your opinion is that a security has an expected rate of return of 10.6%. It has a beta of 1.2 . The risk-free rate is 4% and the market expected rate of return is 10%. According to the Capital Asset Pricing Model, this security is A. underpriced. B. overpriced. C. fairly priced. D. cannot be determined from data provided. E. none of the above. Question 6: The Arbitrage Pricing Theory (APT)... A. tells us how to find common factors among returns B. says that if any two securities have the same exposures to the common factors, they must have the same expected returns C. states that the CAPM is wrong D. assumes there are abundant arbitrage opportunities E. both A and B are correct Question 7: The minimum variance portfolio of risky assets A. has equal covariance with all individual assets B. always has a lower expected return than the tangency portfolio C. has the same or lower variance than all individual risky assets D. all of the above E. none of the above Question 8: Discount rates are A. actual rates of return B. realized rates of return C. historical average returns D. expected returns E. B and C Question 9: Suppose you invest $10,000 into S\&P 500 with the expectation that S\&P will earn 0.8% per month from now on. What do you expect your investment to be worth in 50 years? A. About $15 thousand B. About $470 thousand C. About $740 thousand D. About $980 thousand E. About $1.2 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts