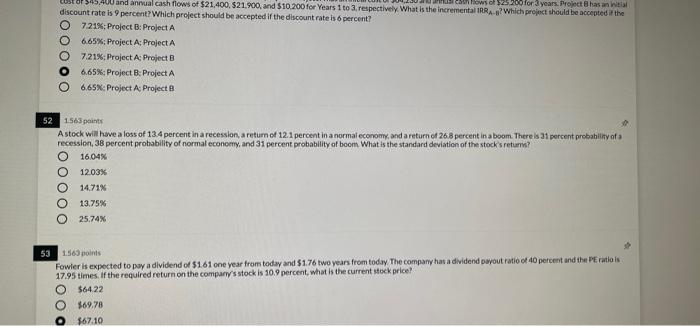

Question: question 52 Caniowe 200 for years. Project has an initial CUSTOP 545.400 and annual cash flows of $21,400, $21.900 and $10.200 for Years 1 to

Caniowe 200 for years. Project has an initial CUSTOP 545.400 and annual cash flows of $21,400, $21.900 and $10.200 for Years 1 to 3. respectively. What is the incremental IRRA ? Which project should be accepted if the discount rate is 9 percent? Which project should be accepted if the discount rate is 6 percent? 7.21%: Project B: Project A 6,65%: Project A: Project A 7.21%: Project A: Project B 6.65% Project B. Project A 6,65%: Project A: Project B 52 1565 points Astock will have a loss of 13.4 percent in a recession, a return of 12.1 percent in a normal economy, and a return of 26.8 percent in a boom. There is 31 percent probability of a recession, 38 percent probability of normal economy and 31 percent probability of boom. What is the standard deviation of the stock's returns? 16,04% 1203% 14.71% 13.75% 25.74% 53 1.565 points Fowler is expected to pay a dividend of $1.61 one year from today and $176 two years from today. The company has a dividend payout ratio of 40 percent and the PE ratio is 17.95 times. If the required return on the company's stock is 10.9 percent what is the current stock price! $64.22 $69.78 $67.10 DOO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts