Question: question 5.7.8 Question 7 (1 point) In the current year, Song Company introduces a new product that includes a two-year warranty on parts. During the

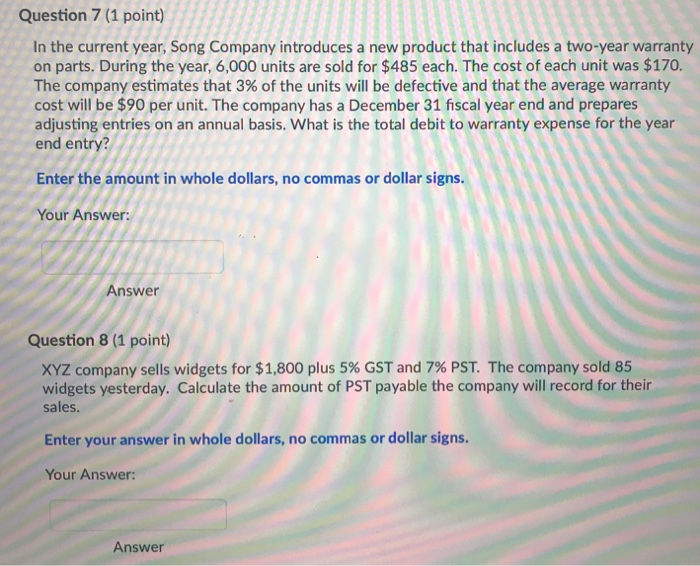

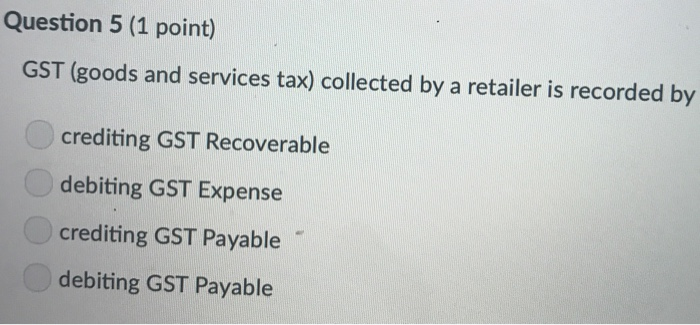

Question 7 (1 point) In the current year, Song Company introduces a new product that includes a two-year warranty on parts. During the year, 6,000 units are sold for $485 each. The cost of each unit was $170 The company estimates that 3% of the units will be defective and that the average warranty cost will be $90 per unit. The company has a December 31 fiscal year end and prepares adjusting entries on an annual basis. What is the total debit to warranty expense for the year end entry? Enter the amount in whole dollars, no commas or dollar signs. Your Answer: Answer Question 8 (1 point) XYZ company sells widgets for $1,800 plus 5% GST and 7% PST. The company sold 85 widgets yesterday. Calculate the amount of PST payable the company will record for their sales. Enter your answer in whole dollars, no commas or dollar signs. Your Answer: Answer Question 5 (1 point) GST (goods and services tax) collected by a retailer is recorded by crediting GST Recoverable debiting GST Expense crediting GST Payable debiting GST Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts