Question: Question 6 0/1 point DogChew Products needs to replace its rawhide tanning and molding equipment. It can be used for five years and will have

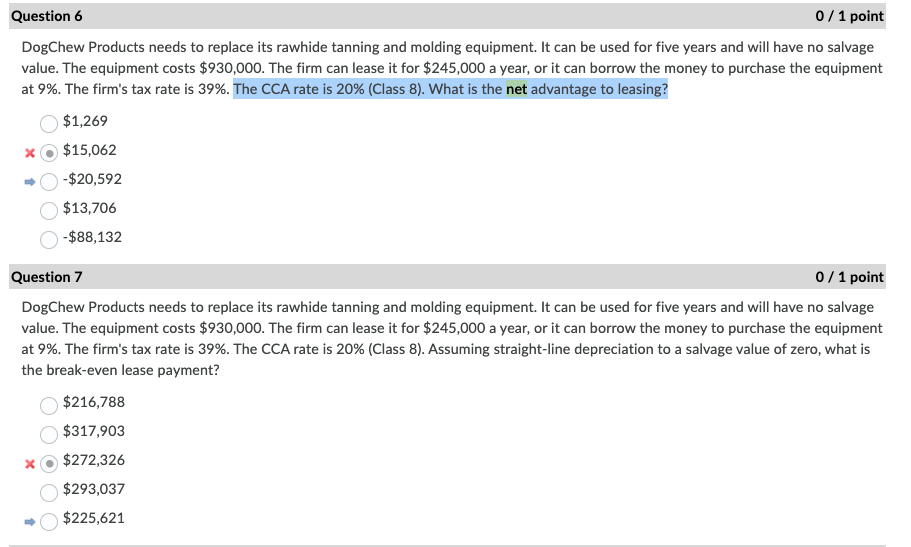

Question 6 0/1 point DogChew Products needs to replace its rawhide tanning and molding equipment. It can be used for five years and will have no salvage value. The equipment costs $930,000. The firm can lease it for $245,000 a year, or it can borrow the money to purchase the equipment at 9%. The firm's tax rate is 39%. The CCA rate is 20% (Class 8). What is the net advantage to leasing? $1,269 $15,062 x -$20,592 $13,706 -$88,132 Question 7 0/1 point DogChew Products needs to replace its rawhide tanning and molding equipment. It can be used for five years and will have no salvage value. The equipment costs $930,000. The firm can lease it for $245,000 a year, or it can borrow the money to purchase the equipment at 9%. The firm's tax rate is 39%. The CCA rate is 20% (Class 8). Assuming straight-line depreciation to a salvage value of zero, what is the break-even lease payment? $216,788 $317,903 $272,326 $293,037 $225,621 Question 6 0/1 point DogChew Products needs to replace its rawhide tanning and molding equipment. It can be used for five years and will have no salvage value. The equipment costs $930,000. The firm can lease it for $245,000 a year, or it can borrow the money to purchase the equipment at 9%. The firm's tax rate is 39%. The CCA rate is 20% (Class 8). What is the net advantage to leasing? $1,269 $15,062 x -$20,592 $13,706 -$88,132 Question 7 0/1 point DogChew Products needs to replace its rawhide tanning and molding equipment. It can be used for five years and will have no salvage value. The equipment costs $930,000. The firm can lease it for $245,000 a year, or it can borrow the money to purchase the equipment at 9%. The firm's tax rate is 39%. The CCA rate is 20% (Class 8). Assuming straight-line depreciation to a salvage value of zero, what is the break-even lease payment? $216,788 $317,903 $272,326 $293,037 $225,621

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts