Question: Question 6 (1 point) Consider a two-period (three dates) at-the money call option written on a $5 stock that can go up or down 15

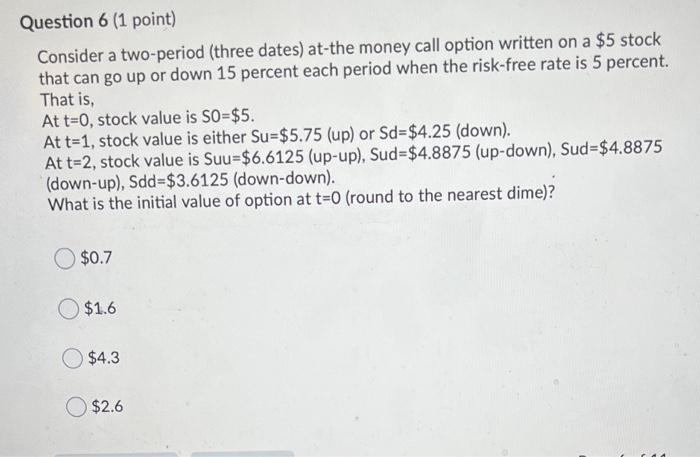

Question 6 (1 point) Consider a two-period (three dates) at-the money call option written on a $5 stock that can go up or down 15 percent each period when the risk-free rate is 5 percent. That is, At t=0, stock value is SO=$5. At t=1, stock value is either Su=$5.75 (up) or Sd=$4.25 (down). At t=2, stock value is Suu=$6.6125 (up-up), Sud=$4.8875 (up-down), Sud=$4.8875 (down-up), Sdd=$3.6125 (down-down). What is the initial value of option at t=0 (round to the nearest dime)? O $0.7 $1.6 $4.3 O $2.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts