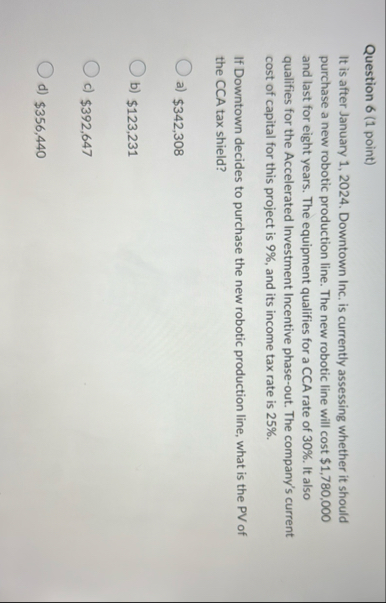

Question: Question 6 ( 1 point ) It is after January 1 , 2 0 2 4 . Downtown Inc. is currently assessing whether it should

Question point

It is after January Downtown Inc. is currently assessing whether it should purchase a new robotic production line. The new robotic line will cost $ and last for eight years. The equipment qualifies for a CCA rate of It also qualifies for the Accelerated Investment Incentive phaseout. The company's current cost of capital for this project is and its income tax rate is

If Downtown decides to purchase the new robotic production line, what is the PV of the CCA tax shield?

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock