Question: Question 9 ( 1 point ) It is after January 1 , 2 0 2 4 . A seven - year project will provide before

Question point

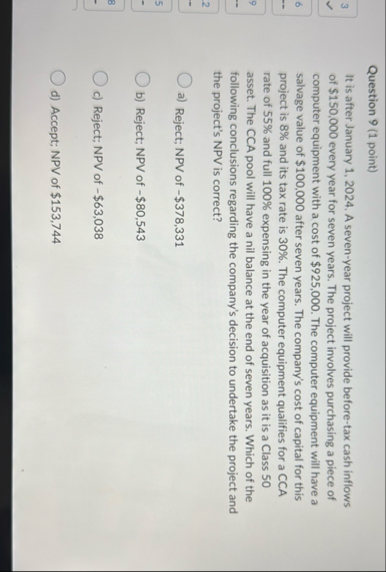

It is after January A sevenyear project will provide beforetax cash inflows of $ every year for seven years. The project involves purchasing a piece of computer equipment with a cost of $ The computer equipment will have a salvage value of $ after seven years. The company's cost of capital for this project is and its tax rate is The computer equipment qualifies for a CCA rate of and full expensing in the year of acquisition as it is a Class asset. The CCA pool will have a nil balance at the end of seven years. Which of the following conclusions regarding the company's decision to undertake the project and the project's NPV is correct?

a Reject; NPV of $

b Reject; NPV of $

c Reject; NPV of $

d Accept; NPV of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock