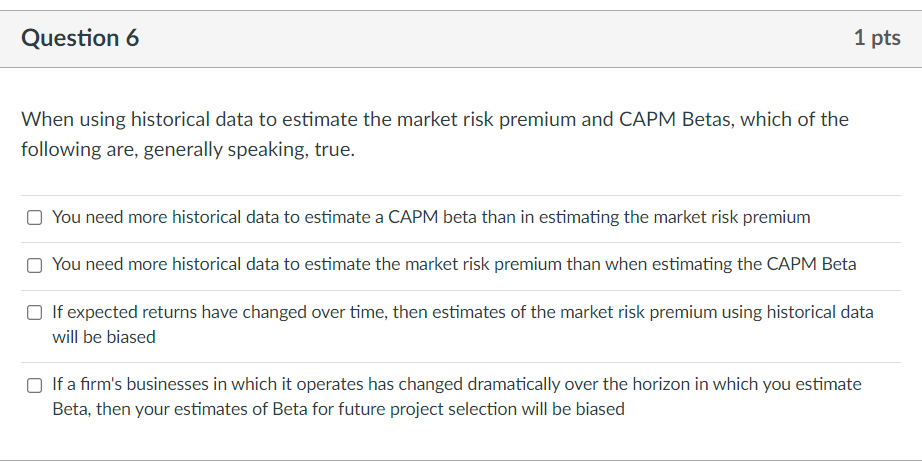

Question: Question 6 1 pts When using historical data to estimate the market risk premium and CAPM Betas, which of the following are, generally speaking, true.

Question 6 1 pts When using historical data to estimate the market risk premium and CAPM Betas, which of the following are, generally speaking, true. You need more historical data to estimate a CAPM beta than in estimating the market risk premium You need more historical data to estimate the market risk premium than when estimating the CAPM Beta If expected returns have changed over time, then estimates of the market risk premium using historical data will be biased If a firm's businesses in which it operates has changed dramatically over the horizon in which you estimate Beta, then your estimates of Beta for future project selection will be biased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts