Question: Question 6: (12 marks) Smith and Olson have a partnership agreement which includes the following provisions regarding sharing net income or net loss (a) A

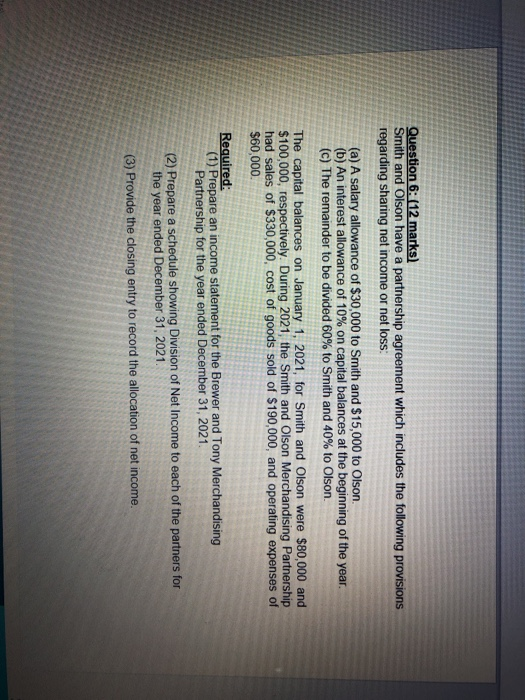

Question 6: (12 marks) Smith and Olson have a partnership agreement which includes the following provisions regarding sharing net income or net loss (a) A salary allowance of $30,000 to Smith and $15,000 to Olson. (b) An interest allowance of 10% on capital balances at the beginning of the year. (c) The remainder to be divided 60% to Smith and 40% to Olson. The capital balances on January 1, 2021, for Smith and Olson were $80,000 and $100,000, respectively. During 2021, the Smith and Olson Merchandising Partnership had sales of $330,000, cost of goods sold of $190,000, and operating expenses of $60,000 Required: (1) Prepare an income statement for the Brewer and Tony Merchandising Partnership for the year ended December 31, 2021. (2) Prepare a schedule showing Division of Net Income to each of the partners for the year ended December 31, 2021. (3) Provide the closing entry to record the allocation of net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts