Question: Question 6 (12 points) PROBLEM 6 (12 points) A firm consists of assets that next year will produce one-time cash flows of S900 if the

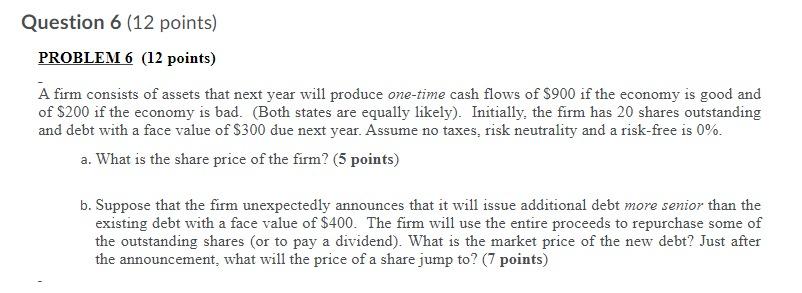

Question 6 (12 points) PROBLEM 6 (12 points) A firm consists of assets that next year will produce one-time cash flows of S900 if the economy is good and of $200 if the economy is bad. (Both states are equally likely). Initially, the firm has 20 shares outstanding and debt with a face value of $300 due next year. Assume no taxes, risk neutrality and a risk-free is 0%. a. What is the share price of the firm? (5 points) b. Suppose that the firm unexpectedly announces that it will issue additional debt more senior than the existing debt with a face value of $400. The firm will use the entire proceeds to repurchase some of the outstanding shares (or to pay a dividend). What is the market price of the new debt? Just after the announcement, what will the price of a share jump to? (7 points) Question 6 (12 points) PROBLEM 6 (12 points) A firm consists of assets that next year will produce one-time cash flows of S900 if the economy is good and of $200 if the economy is bad. (Both states are equally likely). Initially, the firm has 20 shares outstanding and debt with a face value of $300 due next year. Assume no taxes, risk neutrality and a risk-free is 0%. a. What is the share price of the firm? (5 points) b. Suppose that the firm unexpectedly announces that it will issue additional debt more senior than the existing debt with a face value of $400. The firm will use the entire proceeds to repurchase some of the outstanding shares (or to pay a dividend). What is the market price of the new debt? Just after the announcement, what will the price of a share jump to? (7 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts