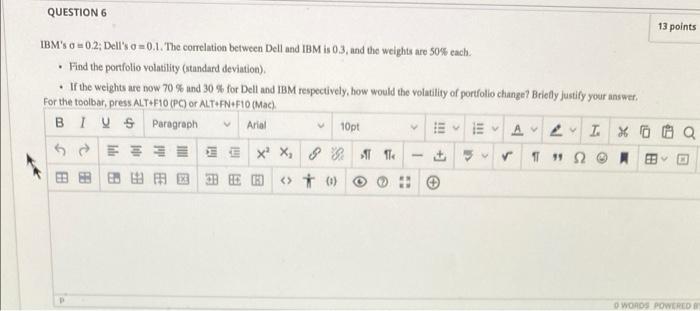

Question: QUESTION 6 13 points IBM's O = 0.2: Dell's o=0.1. The correlation between Dell and IBM is 03, and the weights are 50% each .

QUESTION 6 13 points IBM's O = 0.2: Dell's o=0.1. The correlation between Dell and IBM is 03, and the weights are 50% each . Find the portfolio volatility (standard deviation) If the weights are now 70% and 30% for Dell and IBM respectively, how would the Volatility of portfolio change? Brielly Justify your answer. For the toolbar, press ALT+F10 (PC) of ALT+FN+F10 (Mac), B IV. Paragraph 10pt AZ IXO 633 XX, The 1952 ) Arial + B WORDS POWERED

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts