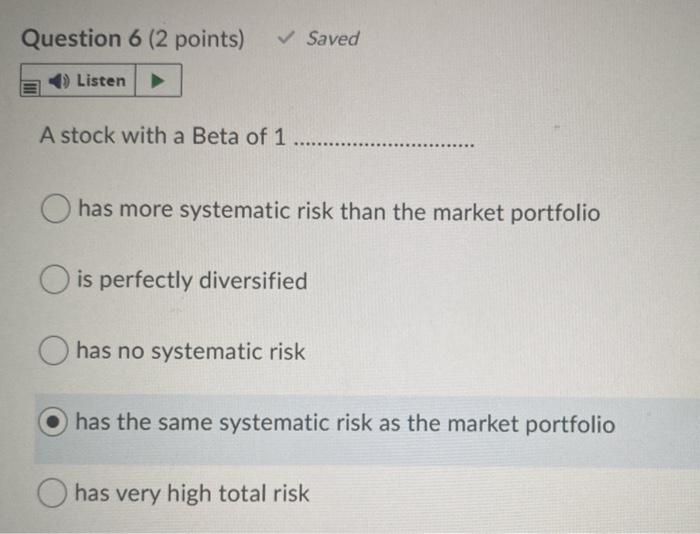

Question: Question 6 (2 points) Saved Listen A stock with a Beta of 1 has more systematic risk than the market portfolio O is perfectly diversified

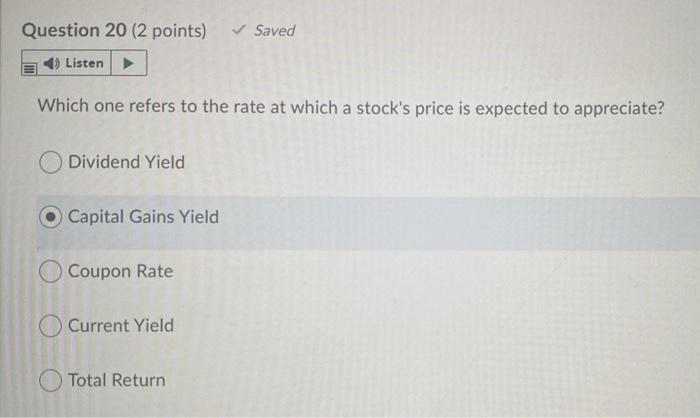

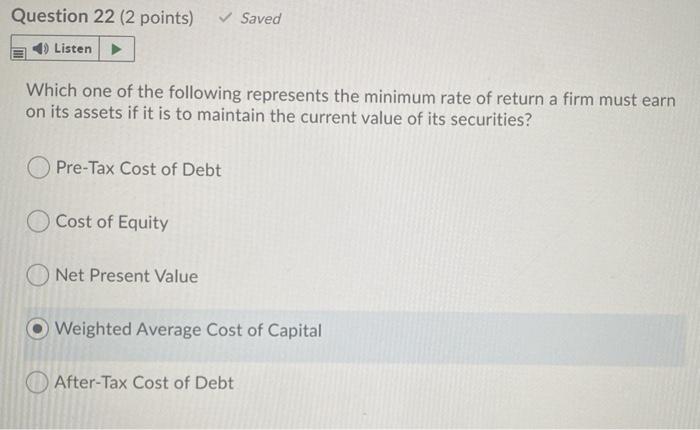

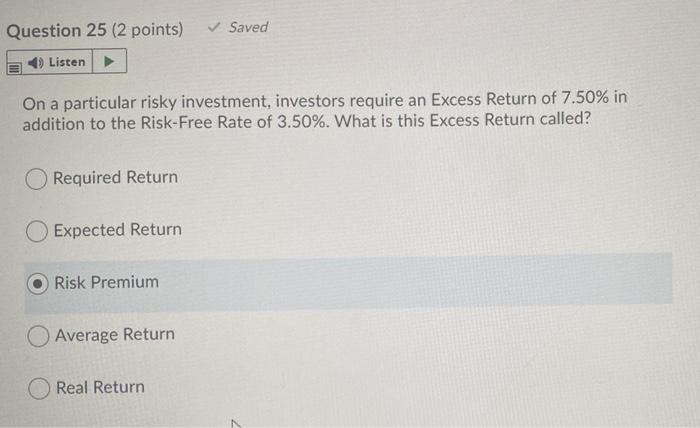

Question 6 (2 points) Saved Listen A stock with a Beta of 1 has more systematic risk than the market portfolio O is perfectly diversified has no systematic risk has the same systematic risk as the market portfolio has very high total risk Question 20 (2 points) Saved Listen Which one refers to the rate at which a stock's price is expected to appreciate? Dividend Yield Capital Gains Yield Coupon Rate Current Yield Total Return Question 22 (2 points) Saved Listen Which one of the following represents the minimum rate of return a firm must earn on its assets if it is to maintain the current value of its securities? Pre-Tax Cost of Debt O Cost of Equity Net Present Value O Weighted Average Cost of Capital After-Tax Cost of Debt Question 25 (2 points) Saved Listen On a particular risky investment, investors require an Excess Return of 7.50% in addition to the Risk-Free Rate of 3.50%. What is this Excess Return called? Required Return O Expected Return Risk Premium Average Return Real Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts