Question: Question 6 20 pts Part II. Problems (2 problems worth 20 points total) . 1.(10 points) Harold and Rosemary, married with three dependent children, operate

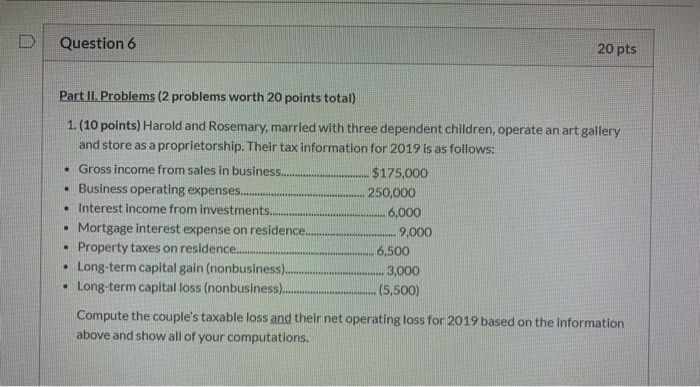

Question 6 20 pts Part II. Problems (2 problems worth 20 points total) . 1.(10 points) Harold and Rosemary, married with three dependent children, operate an art gallery and store as a proprietorship. Their tax information for 2019 is as follows: Gross income from sales in business $175,000 Business operating expenses... 250,000 Interest income from investments.. 6,000 Mortgage interest expense on residence. 9,000 Property taxes on residence... 6,500 Long-term capital gain (nonbusiness)... 3,000 Long-term capital loss (nonbusiness).. (5,500) . Compute the couple's taxable loss and their net operating loss for 2019 based on the information above and show all of your computations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts