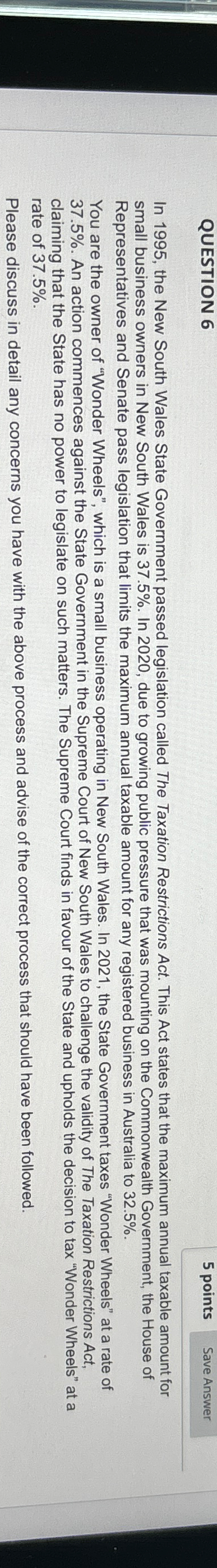

Question: QUESTION 6 5 points In 1 9 9 5 , the New South Wales State Government passed legislation called The Taxation Restrictions Act. This Act

QUESTION

points

In the New South Wales State Government passed legislation called The Taxation Restrictions Act. This Act states that the maximum annual taxable amount for small business owners in New South Wales is In due to growing public pressure that was mounting on the Commonwealth Government, the House of Representatives and Senate pass legislation that limits the maximum annual taxable amount for any registered business in Australia to

You are the owner of "Wonder Wheels", which is a small business operating in New South Wales. In the State Government taxes "Wonder Wheels" at a rate of An action commences against the State Government in the Supreme Court of New South Wales to challenge the validity of The Taxation Restrictions Act, claiming that the State has no power to legislate on such matters. The Supreme Court finds in favour of the State and upholds the decision to tax "Wonder Wheels" at a rate of

Please discuss in detail any concerns you have with the above process and advise of the correct process that should have been followed.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock