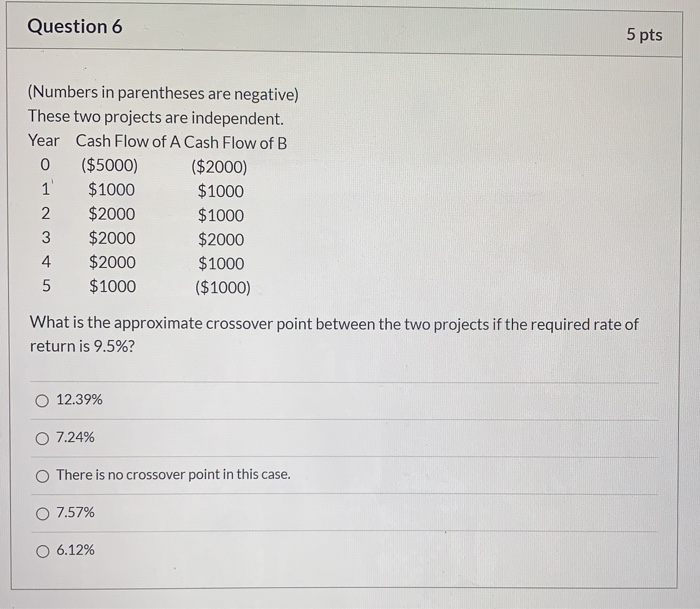

Question: Question 6 5 pts (Numbers in parentheses are negative) These two projects are independent. Year Cash Flow of A Cash Flow of B 0 ($5000)

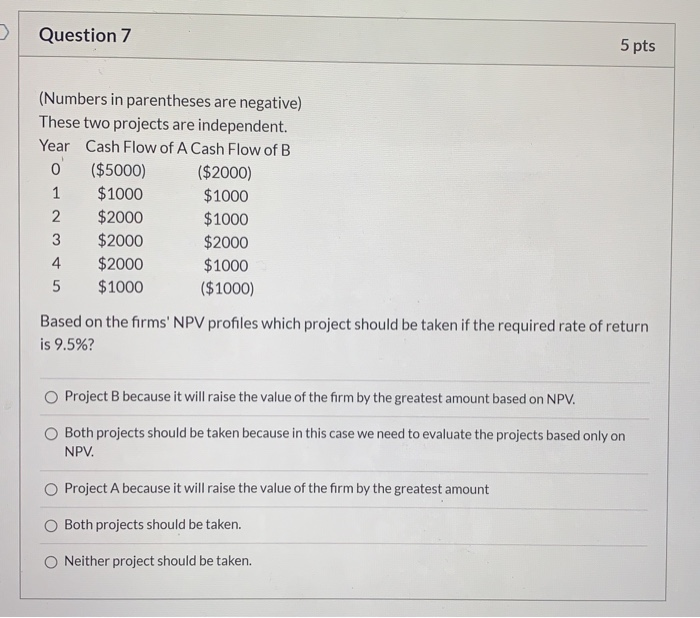

Question 6 5 pts (Numbers in parentheses are negative) These two projects are independent. Year Cash Flow of A Cash Flow of B 0 ($5000) ($2000) 1 $1000 $1000 2 $2000 $1000 3 $2000 $2000 4. $2000 $1000 5 $1000 ($1000) What is the approximate crossover point between the two projects if the required rate of return is 9.5%? 12.39% O 7.24% There is no crossover point in this case. 0 7.57% O 6.12% Question 7 5 pts (Numbers in parentheses are negative) These two projects are independent. Year Cash Flow of A Cash Flow of B 0 ($5000) ($2000) 1 $1000 $1000 2 $2000 $1000 3 $2000 $2000 4 $2000 $1000 5 $1000 ($1000) Based on the firms' NPV profiles which project should be taken if the required rate of return is 9.5%? Project B because it will raise the value of the firm by the greatest amount based on NPV. Both projects should be taken because in this case we need to evaluate the projects based only on NPV. O Project A because it will raise the value of the firm by the greatest amount Both projects should be taken. Neither project should be taken

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts