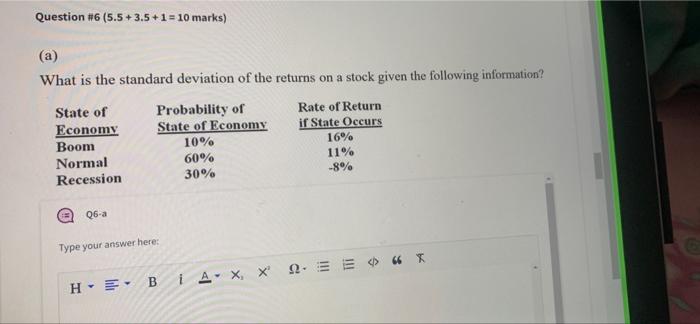

Question: Question #6 (5.5 +3.5+1 = 10 marks) (a) What is the standard deviation of the returns on a stock given the following information? State of

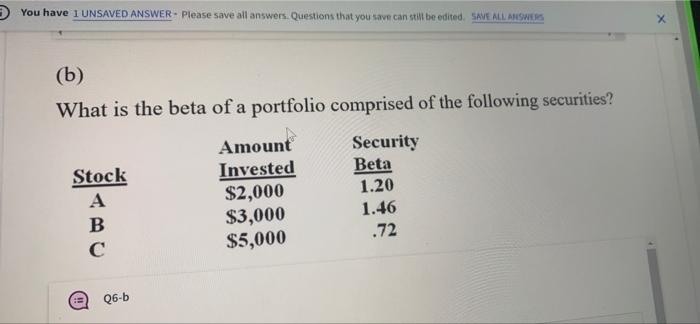

Question #6 (5.5 +3.5+1 = 10 marks) (a) What is the standard deviation of the returns on a stock given the following information? State of Economy Boom Normal Recession Probability of State of Economy 10% 60% 30% Rate of Return if State Occurs 16% 11% -8% Q6-a Type your answer here: HEB i AX 9.5 6 You have 1 UNSAVED ANSWER. Please save all answers, Questions that you save can be edited. SAVE ALL ANSWERS X (b) What is the beta of a portfolio comprised of the following securities? Amount Security Stock Invested Beta A $2,000 1.20 B $3,000 1.46 $5,000 .72 Q6-b Q6-c (c) in Part (b), which stock has the highest systematic risk? H- Bi A X X 2.3 E 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts