Question: you are given the following information for a security state of economy boom normal recession TEST QUESTIONS: IMPORTANT: SHOW YOUR DETAILED SOLUTIONS FOR EACH QUESTION

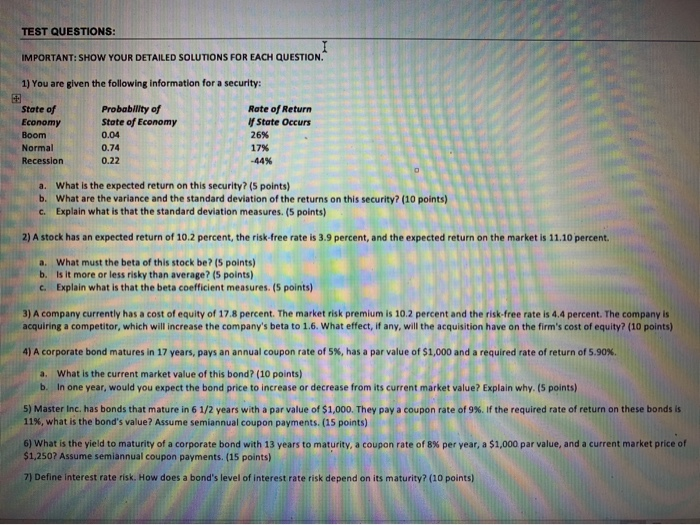

TEST QUESTIONS: IMPORTANT: SHOW YOUR DETAILED SOLUTIONS FOR EACH QUESTION 1) You are given the following information for a security: State of Economy Boom Normal Recession Probability of State of Economy 0.04 Rote of Return State Occurs 26% 17% 0.74 0.22 -44% a. What is the expected return on this security? (5 points) b. What are the variance and the standard deviation of the returns on this security? (10 points) c. Explain what is that the standard deviation measures. (5 points) 2) A stock has an expected return of 10.2 percent, the risk-free rate is 3.9 percent, and the expected return on the market is 11.10 percent. a. What must the beta of this stock be? (5 points) b. Is it more or less risky than average? (5 points) c. Explain what is that the beta coefficient measures. (5 points) What must the beta of this stock be? (5 points) 3) A company currently has a cost of equity of 17.8 percent. The market risk premium is 10.2 percent and the risk-free rate is 4.4 percent. The company is acquiring a competitor, which will increase the company's beta to 1.6. What effect, if any, will the acquisition have on the firm's cost of equity? (10 points) , wel the acquisition have on the 4) A corporate bond matures in 17 years, pays an annual coupon rate of 5%, has a par value of $1,000 and a required rate of return of 5.90%. ond matures in 17 years, pays an annual commen t the bond price to in $1.000. They pay a coupon a. What is the current market value of this bond? (10 points) b. In one year, would you expect the bond price to increase or decrease from its current market value? Explain why. (5 points) 5) Master Inc. has bonds that mature in 6 1/2 years with a par value of $1,000. They pay a coupon rate of 9%. If the required rate of return on these bonds is 11%, what is the bond's value? Assume semiannual coupon payments. (15 points) 6) What is the yield to maturity of a corporate bond with 13 years to maturity, a coupon rate of 8% per year, a $1,000 par value, and a current market price of $1,250? Assume semiannual coupon payments. (15 points) 7) Define interest rate risk. How does a bond's level of interest rate risk depend on its maturity? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts