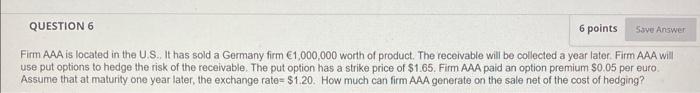

Question: QUESTION 6 6 points Save Answer Firm AAA is located in the U.S.. It has sold a Germany firm 1,000,000 worth of product. The receivable

QUESTION 6 6 points Save Answer Firm AAA is located in the U.S.. It has sold a Germany firm 1,000,000 worth of product. The receivable will be collected a year later. Firm AAA will use put options to hedge the risk of the receivable. The put option has a strike price of $1.65. Firm AAA paid an option premium $0.05 per euro. Assume that at maturity one year later, the exchange rate= $1.20. How much can firm AAA generate on the sale net of the cost of hedging

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts