Question: QUESTION 6 A $1,000 convertible debenture has a conversion price of $75 per share, an annual coupon payment of $55. and a related stock price

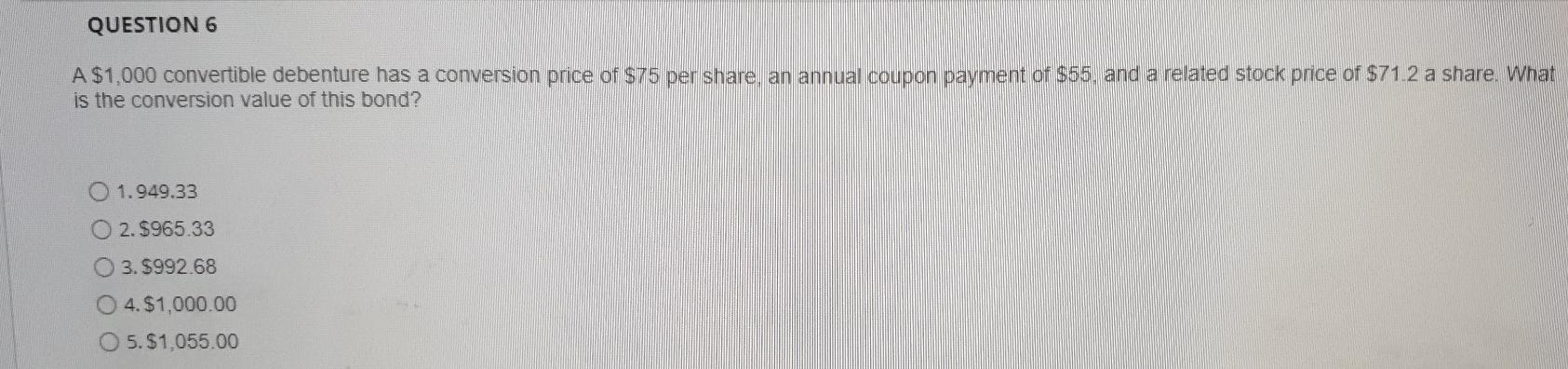

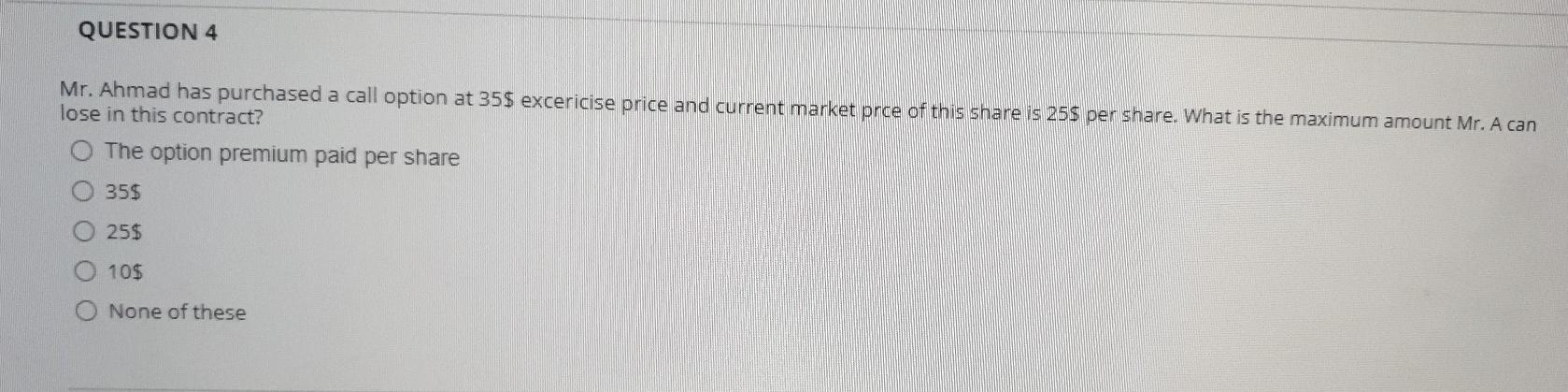

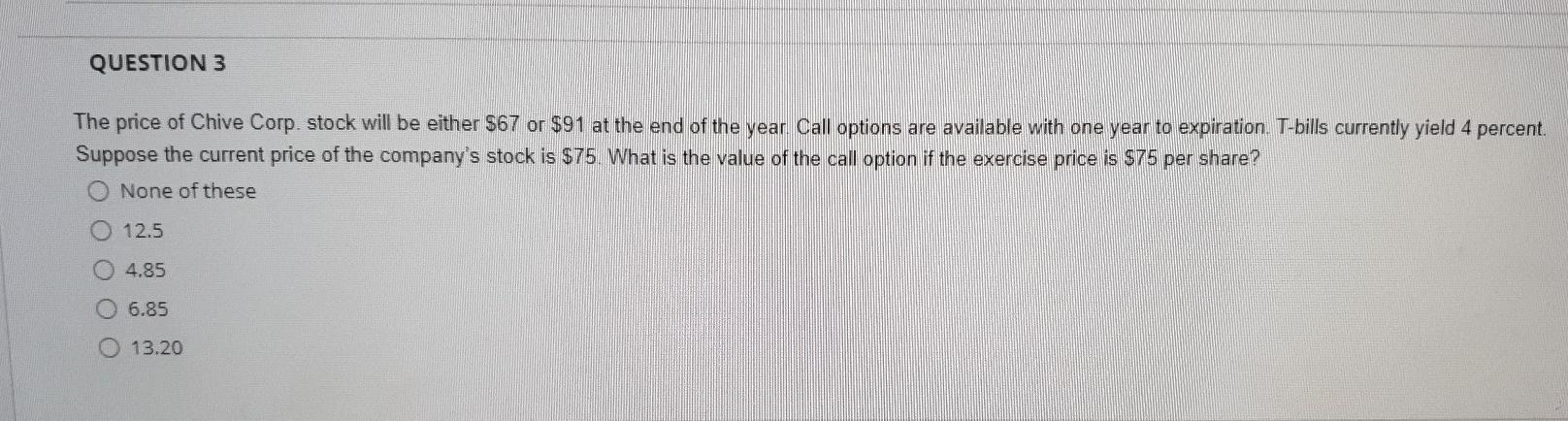

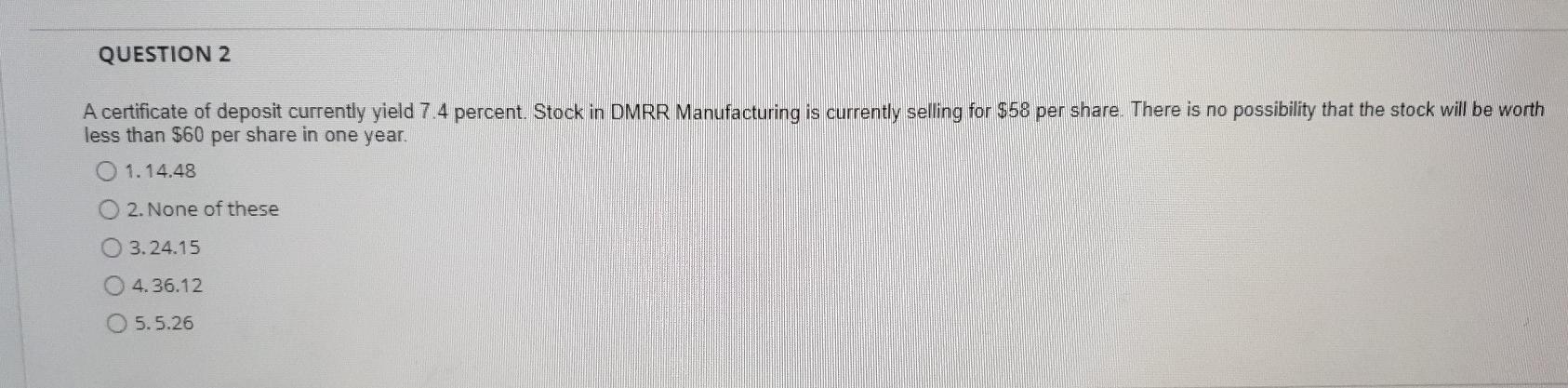

QUESTION 6 A $1,000 convertible debenture has a conversion price of $75 per share, an annual coupon payment of $55. and a related stock price of $71.2 a share. What is the conversion value of this bond? O 1.949.33 O 2. $965.33 3. $992.68 O 4.$1,000.00 O 5. $1.055.00 QUESTION 4 Mr. Ahmad has purchased a call option at 35$ excericise price and current market prce of this share is 25$ per share. What is the maximum amount Mr. A can lose in this contract? The option premium paid per share 35$ 25$ 10$ O None of these QUESTION 3 The price of Chive Corp. stock will be either $67 or $91 at the end of the year . Call options are available with one year to expiration. T-bills currently yield 4 percent. Suppose the current price of the company's stock is $75. What is the value of the call option if the exercise price is $75 per share? None of these 0 12.5 0 4.85 6.85 O 13.20 QUESTION 2 A certificate of deposit currently yield 7.4 percent. Stock in DMRR Manufacturing is currently selling for $58 per share. There is no possibility that the stock will be worth less than $60 per share in one year. O 1.14.48 2. None of these 0 3.24.15 4.36.12 O 5.5.26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts