Question: Question 6: Based on the capital structure theoretical framework, should Mirage Hotels consider funding the investment requirement with debt, equity or a combination of both?

Question 6:

Based on the capital structure theoretical framework, should Mirage Hotels consider funding the investment requirement with debt, equity or a combination of both? Please justify your answer.

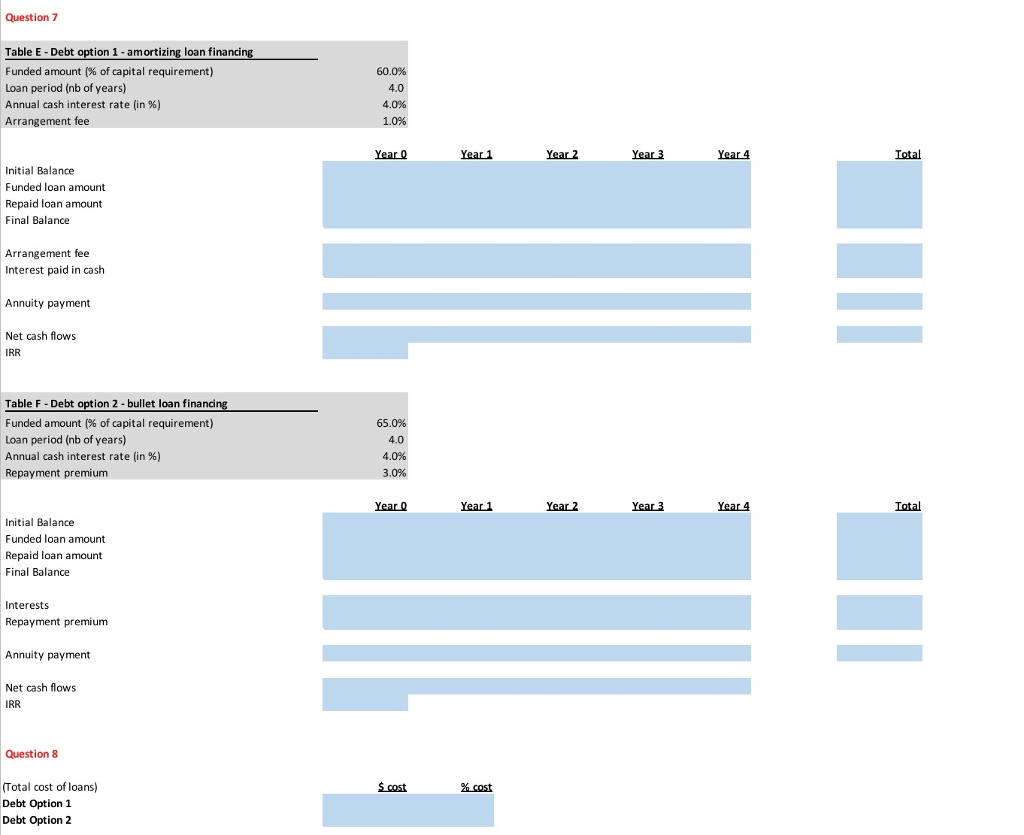

*Question 8: For each debt option, what is the total debt funding cost (for one hotel), both in absolute $ terms and in % terms (using IRR calculation)?

*Question 8: For each debt option, what is the total debt funding cost (for one hotel), both in absolute $ terms and in % terms (using IRR calculation)?

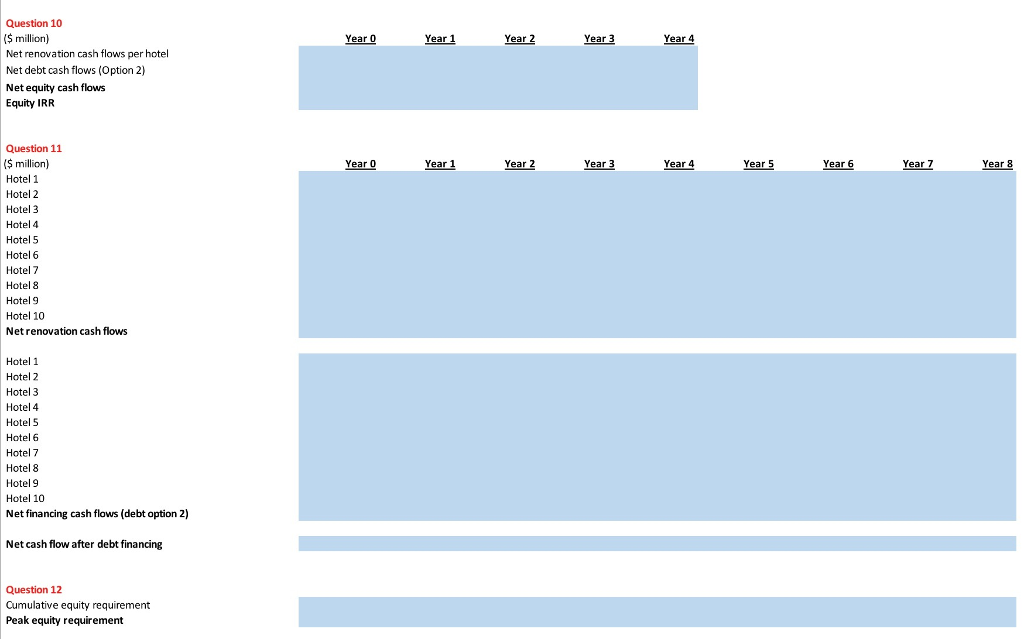

Question 9:

Based on the characteristics of each debt option and the above results, determine the pros and cons of each debt funding option for the hotel renovation program?

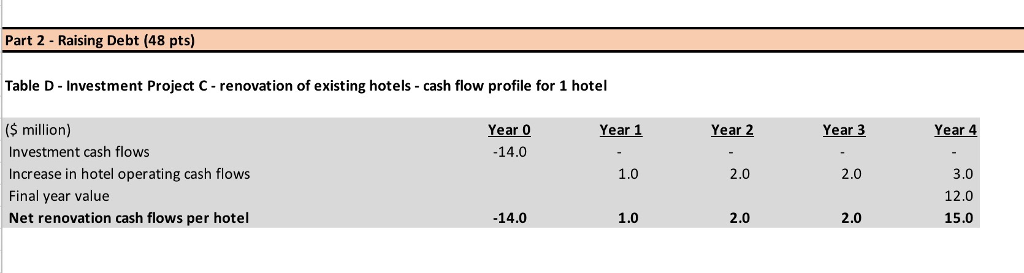

Part 2 - Raising Debt (48 pts) Table D - Investment Project C renovation of existing hotels - cash flow profile for 1 hotel million) Investment cash flows Increase in hotel operating cash flows Final year value Net renovation cash flows per hotel Year 0 Year 1 Year 2 Year 3 Year 4 14.0 1.0 2.0 3.0 12.0 15.0 2.0 14.0 1.0 2.0 2.0 Part 2 - Raising Debt (48 pts) Table D - Investment Project C renovation of existing hotels - cash flow profile for 1 hotel million) Investment cash flows Increase in hotel operating cash flows Final year value Net renovation cash flows per hotel Year 0 Year 1 Year 2 Year 3 Year 4 14.0 1.0 2.0 3.0 12.0 15.0 2.0 14.0 1.0 2.0 2.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts