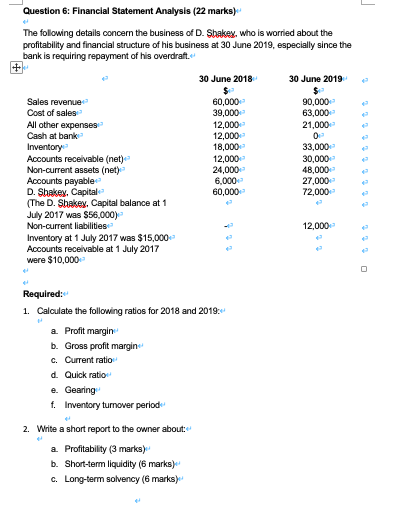

Question: Question 6: Financial Statement Analysis (22 marks) The following details concern the business of D. Shakey, who is worried about the profitability and financial structure

Question 6: Financial Statement Analysis (22 marks)

The following details concern the business of D. Shakey, who is worried about the profitability and financial structure of his business at 30 June 2019, especially since the bank is requiring repayment of his overdraft.

|

| 30 June 2018 $ | 30 June 2019 $ |

| Sales revenue | 60,000 | 90,000 |

| Cost of sales | 39,000 | 63,000 |

| All other expenses | 12,000 | 21,000 |

| Cash at bank | 12,000 | 0 |

| Inventory | 18,000 | 33,000 |

| Accounts receivable (net) | 12,000 | 30,000 |

| Non-current assets (net) | 24,000 | 48,000 |

| Accounts payable | 6,000 | 27,000 |

| D. Shakey, Capital | 60,000 | 72,000 |

| (The D. Shakey, Capital balance at 1 July 2017 was $56,000) |

|

|

| Non-current liabilities | - | 12,000 |

| Inventory at 1 July 2017 was $15,000 |

|

|

| Accounts receivable at 1 July 2017 were $10,000 |

|

|

Required:

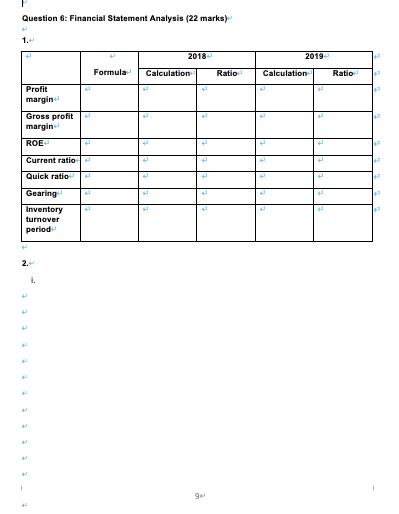

- Calculate the following ratios for 2018 and 2019:

- Profit margin

- Gross profit margin

- Current ratio

- Quick ratio

- Gearing

- Inventory turnover period

- Write a short report to the owner about:

- Profitability (3 marks)

- Short-term liquidity (6 marks)

- Long-term solvency (6 marks)

Question 6: Financial Statement Analysis (22 marks) The following details concern the business of D. Shakes, who is worried about the profitability and financial structure of his business at 30 June 2019, especially since the bank is requiring repayment of his overdraft 30 June 2018 Sales revenue Cost of sales All other expenses Cash at bank Inventory Accounts receivable (net) Non-current assets (net) Accounts payable D. Shakey, Capital (The D. Shakey, Capital balance at 1 July 2017 was $56,000) Non-current liabilities Inventory at 1 July 2017 was $15,000 Accounts receivable at 1 July 2017 were $10,000 60,000 39,000 12,000 12,000 18,000 12,000 24,000 6,000 60,000 30 June 2019 $ 90,000 63,000 21,000 0 33,000 30,000 48,000 27,000 72,000 12,000 3 Required: 1. Calculate the following ratios for 2018 and 2019 a. Profit margin b. Gross profit margin c. Current ratio d. Quick ratio e. Gearing f. Inventory turnover periode 2. Write a short report to the owner about: a Profitability (3 marks) b. Short-term liquidity (6 marks) c. Long-term solvency (6 marks) Question 6: Financial Statement Analysis (22 marks) 1. 2010 2019 Formula Calculation Ratio Calculation Ratio 3 Profit margin- Gross profit margin ROE 3 Current ratio Quick ratio Gearing Inventory turnover period 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts