Question: Question #6 - Net Present Value versus Internal Rate of Return--8 points Shop, Shop, and Shop-Some More is considering the following two-strategic projects. The projects

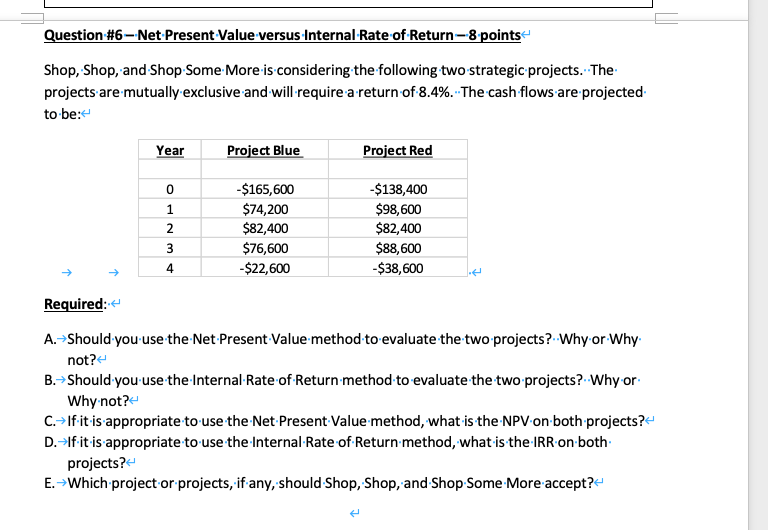

Question #6 - Net Present Value versus Internal Rate of Return--8 points Shop, Shop, and Shop-Some More is considering the following two-strategic projects. The projects are mutually exclusive and will require a return of 8.4%. "The cash flows are projected: to be:- Year Project Blue Project Red 0 1 2 N $165,600 $74,200 $82,400 $76,600 -$22,600 -$138,400 $98,600 $82,400 $88,600 $38,600 3 4 4 Required: A.-Should you use the Net Present Value method to evaluate the two projects? Why or Why not? B.-Should you use the Internal-Rate of Return method to evaluate the two projects? Why or Why not? C.-If it is appropriate to use the Net Present Value method, what is the NPV on both projects?" D.-If it is appropriate to use the Internal Rate of Return method, what is the IRR on both projects? E. Which project or projects, if any, should Shop, Shop, and Shop Some More accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts