Question: Question # 6 : Optimal Risky Pertfolio Obi is trying to construct a risky portfolio that has two assets: a fund that tracks real estate

Question #: Optimal Risky Pertfolio

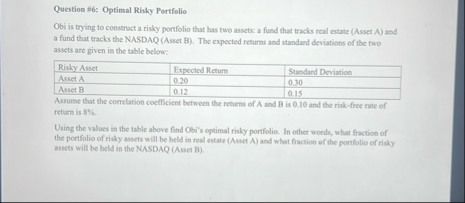

Obi is trying to construct a risky portfolio that has two assets: a fund that tracks real estate Asset A and a fund that tracks the NASDAQ Asset B The expected returns and standaed deviations of the two assets are given in the table below:

tableRisky Asset,Expected Return,Stundard DeviationAsset AAsset B

Assume that the correlation coefficient between the returns of A and B is and the riskfree rate of retirn is

Using the valoes in the table above find Obi's optimal risky portfolio. In other words, what fraction of the portfolio of risky assets will be held in real estate Asset A and what fraction of the portfolio of riaky assets will be held in the NASDAQ Asset B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock