Question: Question 6 Prepare a comparative common size income statement for Dreams Corporation. To an investor, how does the current year compare with the prior year?

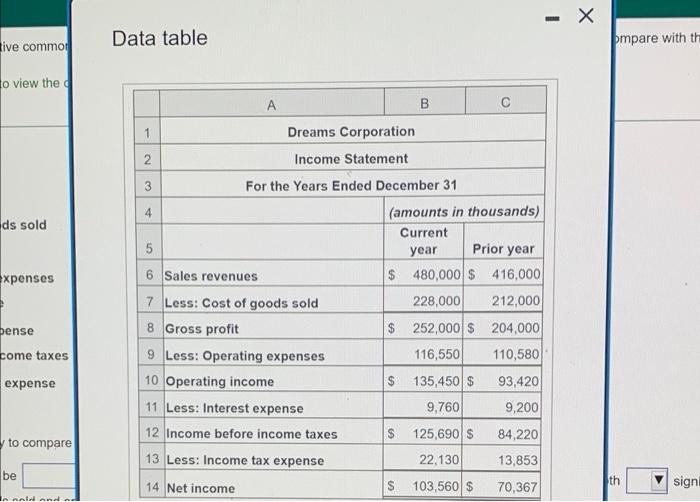

Prepare a comparative common size income statement for Dreams Corporation. To an investor, how does the current year compare with the prior year? Explain your reasoning (Click the icon to view the comparative Income statement.) Prior year Start by calculating the percentages. (Round the percentages to two decimal places, X.XX) Dreams Corporation Comparative Common-Size Income Statement For the Years Ended December 31 Current year Sales revenues 100.00 100.00% Less: Cost of goods sold Gross profit Less: Operating expenses Operating income Less: Interest expense Income before income taxes 30 X Less Income tax expense Net income Prepare a comparative common-size income statement for Dreams Corporation. To an investor, how does the current year compare with the prior year? Explain your reasoning (Click the icon to view the comparative Income statement) Current Year Prior year 100,00 % 96 % % Sales revenues 100.00 Less: Cost of goods sold % Gross profit Less: Operating expenses Operating income Less: Interest expense Income before income taxes Less: Income tax expense Net income Now you are ready to compare the two years, ules ps ce An investor would be with the current year in comparison with the prior year Notes and not income are both significantly from the prior year. Cost of goods sold and operating expenses-the two largest expenses consumed percentages of total revenues in the current year, and net income represents a percentage of revenues Overall profits are - X Data table live commor mpare with th to view the B C 1 Dreams Corporation 2 Income Statement 2 3 ds sold Expenses bense 3 For the Years Ended December 31 4 (amounts in thousands) Current 5 year Prior year 6 Sales revenues $ 480,000 $ 416,000 7 Less: Cost of goods sold 228,000 212,000 8 Gross profit $ 252,000 $ 204,000 9 Less: Operating expenses 116,550 110,580 10 Operating income $ 135,450 $ 93,420 11 Less: Interest expense 9,760 9,200 12 Income before income taxes S 125,690 $ 84,220 13 Less: Income tax expense 22,130 13,853 14 Net income S 103,560 $ 70,367 come taxes expense to compare be th signi Io nold and ad

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts