Question: QUESTION 6 UPLOAD ONLY A SINGLE PDF FILE Your company has a two-step process for evaluating investment projects: first, the conventional payback period must be

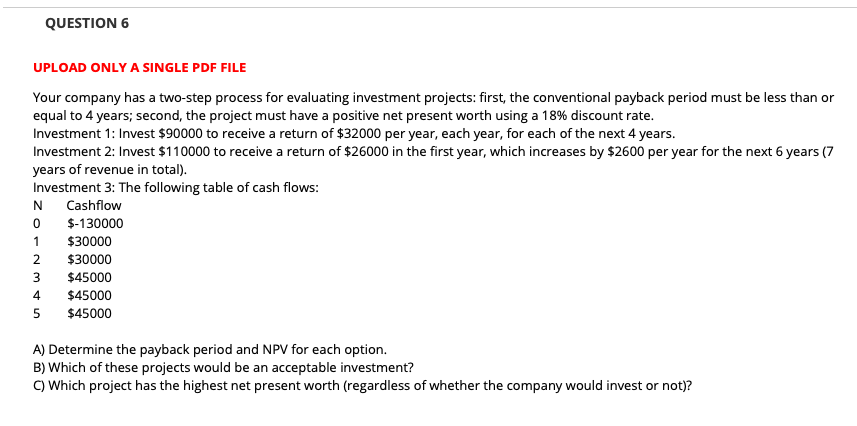

QUESTION 6 UPLOAD ONLY A SINGLE PDF FILE Your company has a two-step process for evaluating investment projects: first, the conventional payback period must be less than or equal to 4 years; second, the project must have a positive net present worth using a 18% discount rate. Investment 1: Invest $90000 to receive a return of $32000 per year, each year, for each of the next 4 years. Investment 2: Invest $110000 to receive a return of $26000 in the first year, which increases by $2600 per year for the next 6 years (7 years of revenue in total). Investment 3: The following table of cash flows: N Cashflow 0 $-130000 1 $30000 2 $30000 $45000 $45000 $45000 A) Determine the payback period and NPV for each option. B) Which of these projects would be an acceptable investment? C) Which project has the highest net present worth (regardless of whether the company would invest or not)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts