Question: Question 6 - Variance Analysis (15 marks) Assume that owners decided to go ahead with the Canmore expansion (first introduced in question 4). The junior

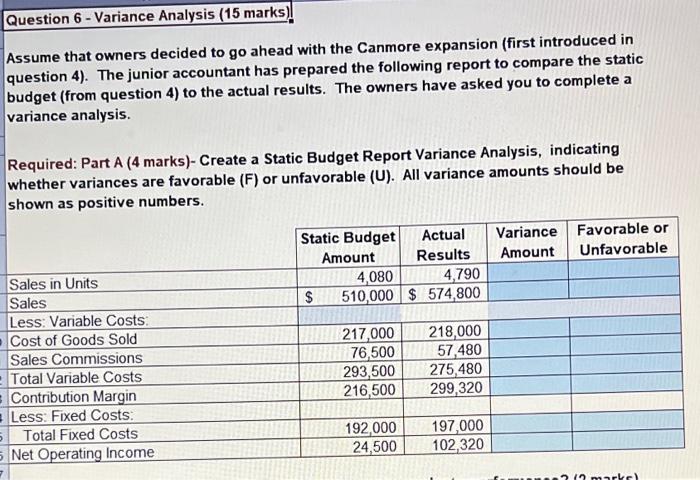

Question 6 - Variance Analysis (15 marks) Assume that owners decided to go ahead with the Canmore expansion (first introduced in question 4). The junior accountant has prepared the following report to compare the static budget (from question 4) to the actual results. The owners have asked you to complete a variance analysis. Required: Part A (4 marks)- Create a Static Budget Report Variance Analysis, indicating whether variances are favorable (F) or unfavorable (U). All variance amounts should be shown as positive numbers. Variance Favorable or Amount Unfavorable Static Budget Actual Amount Results 4,080 4,790 $ 510,000 $ 574,800 Sales in Units Sales Less: Variable Costs: Cost of Goods Sold Sales Commissions - Total Variable Costs Contribution Margin Less: Fixed Costs: 5 Total Fixed Costs 5 Net Operating Income 217,000 76,500 293,500 216,500 218,000 57,480 275,480 299,320 192,000 24,500 197,000 102,320 21 mark) What is the weakness of using a static budget report to evaluate performance? (2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts