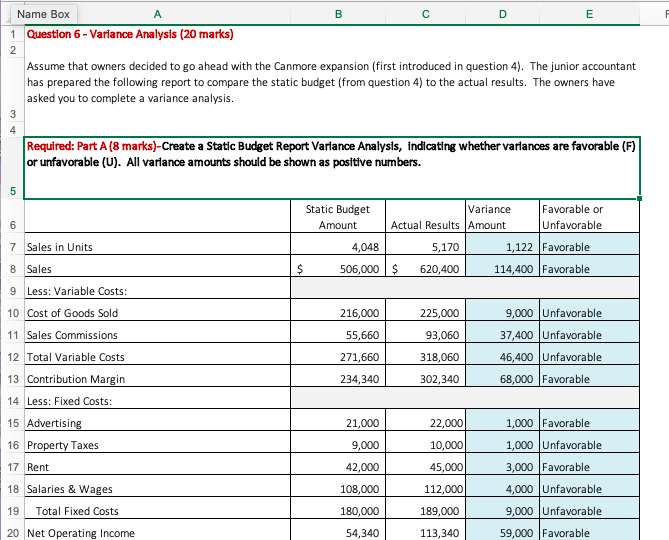

Question: B D E F Name Box 1 Question 6 - Variance Analysis (20 marks) 2 Assume that owners decided to go ahead with the Canmore

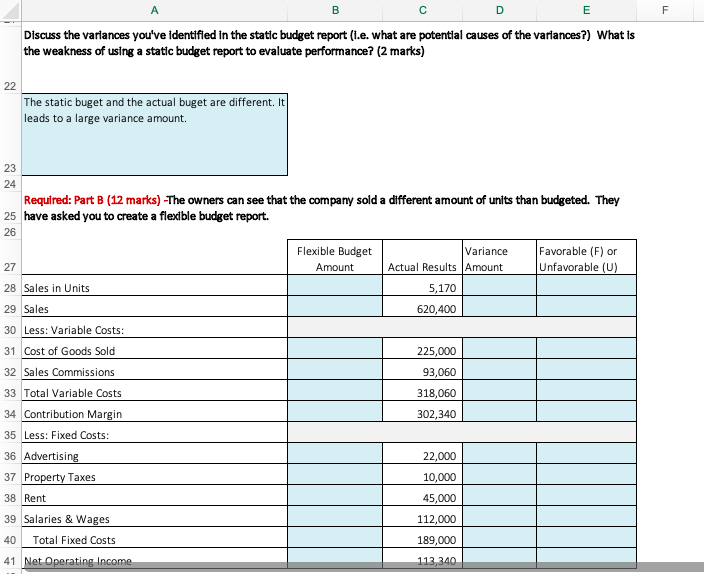

B D E F Name Box 1 Question 6 - Variance Analysis (20 marks) 2 Assume that owners decided to go ahead with the Canmore expansion (first introduced in question 4). The junior accountant has prepared the following report to compare the static budget (from question 4) to the actual results. The owners have asked you to complete a variance analysis. 3 Required: Part A (8 marks)-Create a Static Budget Report Variance Analysis, indicating whether variances are favorable (F) or unfavorable (U). All variance amounts should be shown as positive numbers. 5 6 Static Budget Variance Favorable or Amount Actual Results Amount Unfavorable 4,048 5,170 1,122 Favorable $ 506,000 $ 620,400 114,400 Favorable 216,000 225,000 55,660 93,060 9,000 Unfavorable 37,400 Unfavorable 46,400 Unfavorable 68,000 Favorable 271,660 318,060 234,340 302,340 7 Sales in Units 8 Sales 9 Less: Variable costs: 10 Cost of Goods Sold 11 Sales Commissions 12 Total Variable costs 13 Contribution Margin 14 Less: Fixed Costs: 15 Advertising 16 Property Taxes 17 Rent 18 Salaries & Wages 19 Total Fixed Costs 20 Net Operating Income 21,000 22,000 9,000 10,000 42,000 45,000 1,000 Favorable 1,000 Unfavorable 3,000 Favorable 4,000 Unfavorable 9,000 Unfavorable 59,000 Favorable 108,000 112,000 180,000 189,000 54,340 113,340 B D F E Discuss the variances you've identified in the static budget report (t.e. what are potential causes of the variances?) What is the weakness of using a static budget report to evaluate performance? (2 marks) 22 The static buget and the actual buget are different. It leads to a large variance amount. 23 24 Required: Part B (12 marks) -The owners can see that the company sold a different amount of units than budgeted. They 25 have asked you to create a flexible budget report. 26 Flexible Budget Amount Variance Actual Results Amount Favorable (F) or Unfavorable (0) 27 5,170 620,400 225,000 93,060 318,060 302,340 28 Sales in Units 29 Sales 30 Less: Variable Costs: 31 Cost of Goods Sold 32 Sales Commissions 33 Total Variable costs 34 Contribution Margin 35 Less: Fixed Costs: 36 Advertising 37 Property Taxes 38 Rent 39 Salaries & Wages 40 Total Fixed Costs 41 Net Operating Income 22,000 10,000 45,000 112,000 189,000 113,340 Management was pleased on the results based on the static budget report. Should they be pleased? What does the flexible budget tell you? What are your recommendations to management based on the flexible budget report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts