Question: Question 6 View Policies Current Attempt in Progress The accountant at Pharoah Company is figuring out the difference in income taxes the company will pay

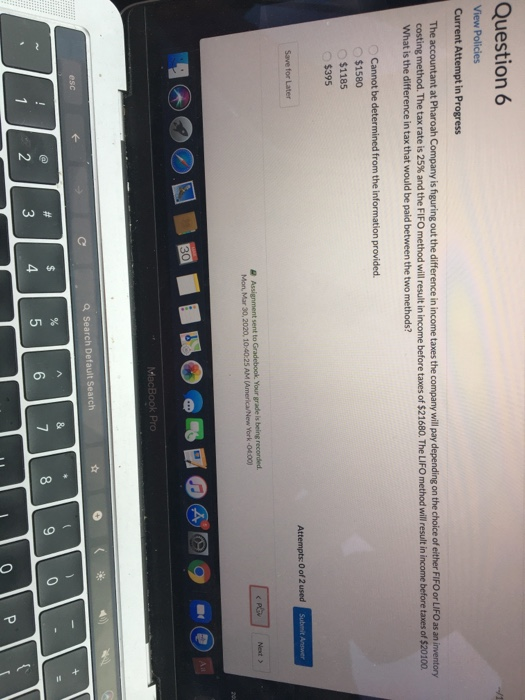

Question 6 View Policies Current Attempt in Progress The accountant at Pharoah Company is figuring out the difference in income taxes the company will pay depending on the choice of either FIFO or LIFO as an inventory costing method. The tax rate is 25% and the FIFO method will result in income before taxes of $21680. The LIFO method will result in income before taxes of $20100. What is the difference in tax that would be paid between the two methods? Cannot be determined from the information provided $1580 $1185 $395 Attempts: 0 of 2 used Submit Answer Save for Later CP Assignment sent to Gradebook Your grade is being recorded. Mon Mar 30, 2020, 10:40:25 AM (America/New York 04.00 MacBook Pro * c a esc Search Default Search * W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts