Question: Question 64 (7 points) Consider the following events for three different companies. (a) McMeekin Company, which has a financial year end of December 31, purchased

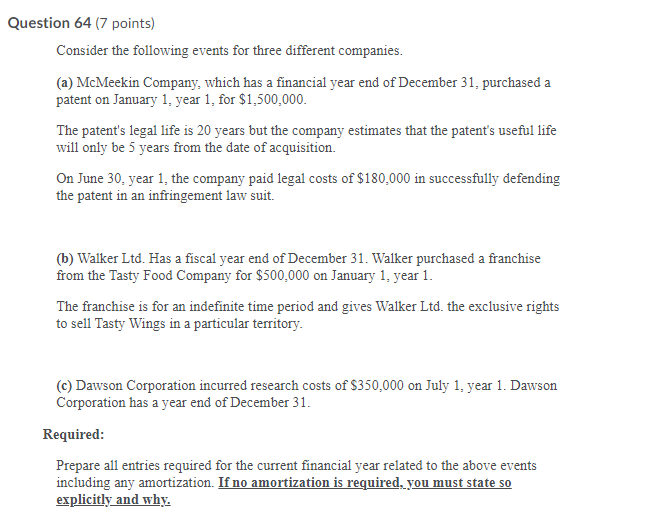

Question 64 (7 points) Consider the following events for three different companies. (a) McMeekin Company, which has a financial year end of December 31, purchased a patent on January 1, year 1, for $1,500,000. The patent's legal life is 20 years but the company estimates that the patent's useful life will only be 5 years from the date of acquisition. On June 30, year 1, the company paid legal costs of $180,000 in successfully defending the patent in an infringement law suit. (b) Walker Ltd. Has a fiscal year end of December 31. Walker purchased a franchise from the Tasty Food Company for $500,000 on January 1, year 1. The franchise is for an indefinite time period and gives Walker Ltd. the exclusive rights to sell Tasty Wings in a particular territory. (c) Dawson Corporation incurred research costs of $350,000 on July 1, year 1. Dawson Corporation has a year end of December 31. Required: Prepare all entries required for the current financial year related to the above events including any amortization. If no amortization is required, you must state so explicitly and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts