Question: Question 7 0 1 DEF Inc. is expected to pay dividends of $ 1 , $ 1 . 5 0 , and $ 2 during

Question

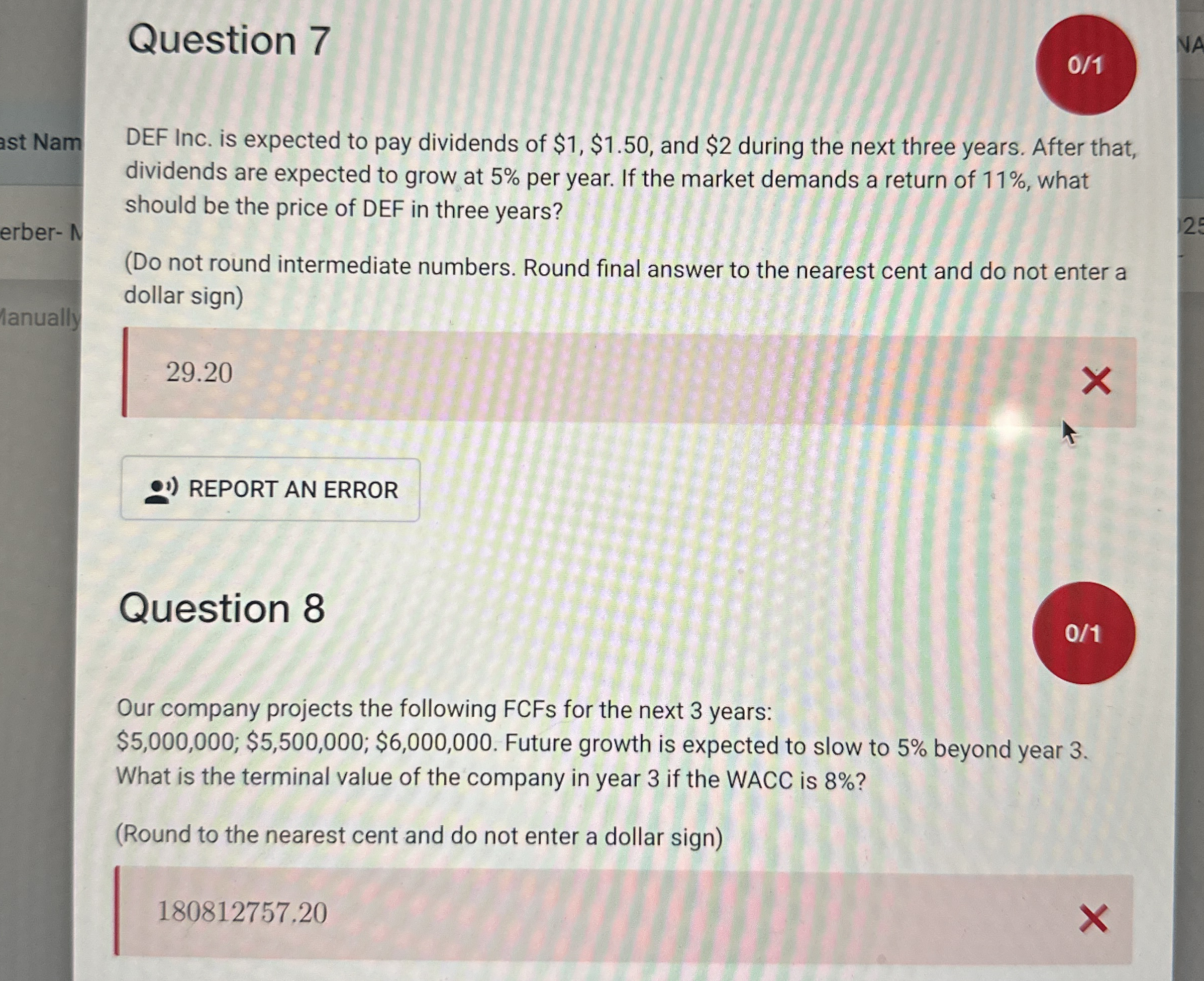

DEF Inc. is expected to pay dividends of $$ and $ during the next three years. After that, dividends are expected to grow at per year. If the market demands a return of what should be the price of DEF in three years?

Do not round intermediate numbers. Round final answer to the nearest cent and do not enter a dollar sign

Question

Our company projects the following FCFs for the next years: $;$;$ Future growth is expected to slow to beyond year What is the terminal value of the company in year if the WACC is

Round to the nearest cent and do not enter a dollar sign

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock