Question: Question 7 (0.9 points) Over the next three years, the expected path of 1-year interest rates is 1, 2, and 1 percent, and the 1-year,

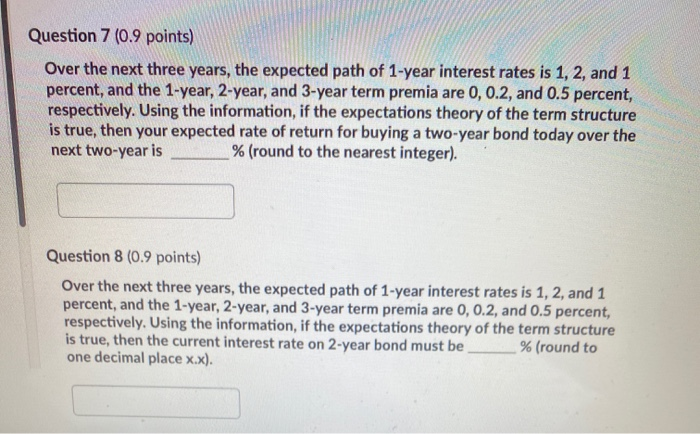

Question 7 (0.9 points) Over the next three years, the expected path of 1-year interest rates is 1, 2, and 1 percent, and the 1-year, 2-year, and 3-year term premia are 0, 0.2, and 0.5 percent, respectively. Using the information, if the expectations theory of the term structure is true, then your expected rate of return for buying a two-year bond today over the next two-year is % (round to the nearest integer). Question 8 (0.9 points) Over the next three years, the expected path of 1-year interest rates is 1, 2, and 1 percent, and the 1-year, 2-year, and 3-year term premia are 0, 0.2, and 0.5 percent, respectively. Using the information, if the expectations theory of the term structure is true, then the current interest rate on 2-year bond must be % (round to one decimal place x.x). Question 7 (0.9 points) Over the next three years, the expected path of 1-year interest rates is 1, 2, and 1 percent, and the 1-year, 2-year, and 3-year term premia are 0, 0.2, and 0.5 percent, respectively. Using the information, if the expectations theory of the term structure is true, then your expected rate of return for buying a two-year bond today over the next two-year is % (round to the nearest integer). Question 8 (0.9 points) Over the next three years, the expected path of 1-year interest rates is 1, 2, and 1 percent, and the 1-year, 2-year, and 3-year term premia are 0, 0.2, and 0.5 percent, respectively. Using the information, if the expectations theory of the term structure is true, then the current interest rate on 2-year bond must be % (round to one decimal place x.x)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts