Question: Question 7 (1 point) Consider a project that costs $5000 and has an expected future cash flow of $1000 per year for 20 years. If

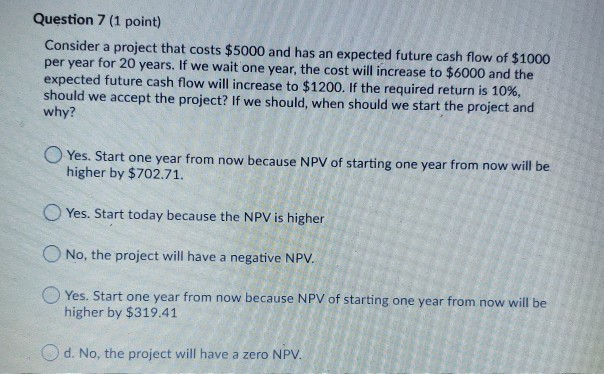

Question 7 (1 point) Consider a project that costs $5000 and has an expected future cash flow of $1000 per year for 20 years. If we wait one year, the cost will increase to $6000 and the expected future cash flow will increase to $1200. If the required return is 10%, should we accept the project? If we should, when should we start the project and why? Yes. Start one year from now because NPV of starting one year from now will be higher by $702.71. Yes. Start today because the NPV is higher No, the project will have a negative NPV. Yes. Start one year from now because NPV of starting one year from now will be higher by $319.41 d. No, the project will have a zero NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts