Question: Question 7 (1 point) D Jonkin & Co's before tax cost of debt is 11%, its marginal tax rate is 34%, and its cost of

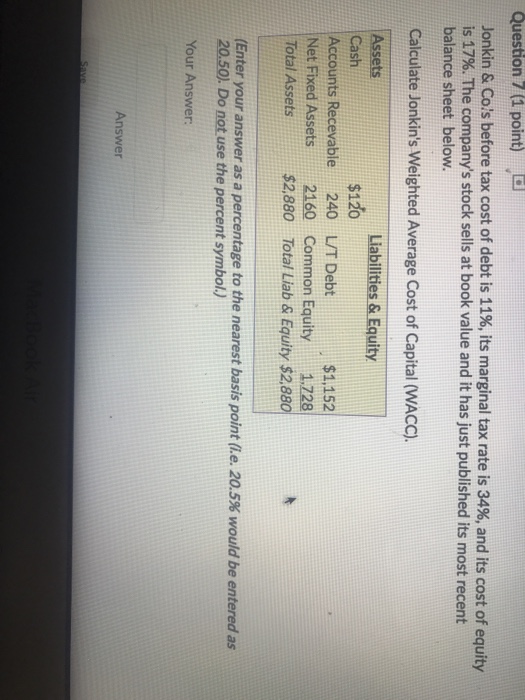

Question 7 (1 point) D Jonkin & Co's before tax cost of debt is 11%, its marginal tax rate is 34%, and its cost of equity is 17%. The company's stock sells at book value and it has just published its most recent balance sheet below. Calculate Jonkin's Weighted Average Cost of Capital (WACC) Assets Cash Accounts Recevable 240 L/T Debt Net Fixed Assets 2160 Common Equity 1.728 Total Assets $120 $1,152 $2,880 Total Liab & Equity $2,880 (Enter your answer as a percentage to the nearest basis point (i.e. 20.5% would be entered as 20.50). Do not use the percent symbol.) Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts