Question: Use the following information about Singer Corp. for problems 7-11. Common stock: 15,000 shares outstanding, $105 per share. Singer will pay a dividend of $2

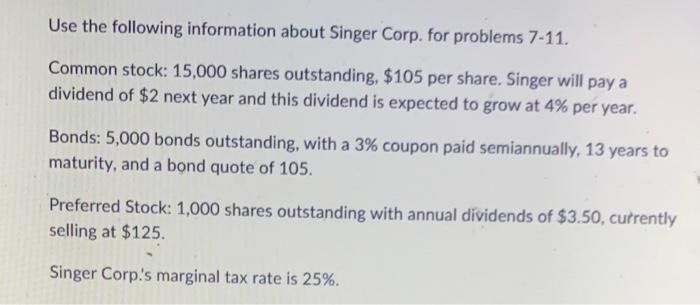

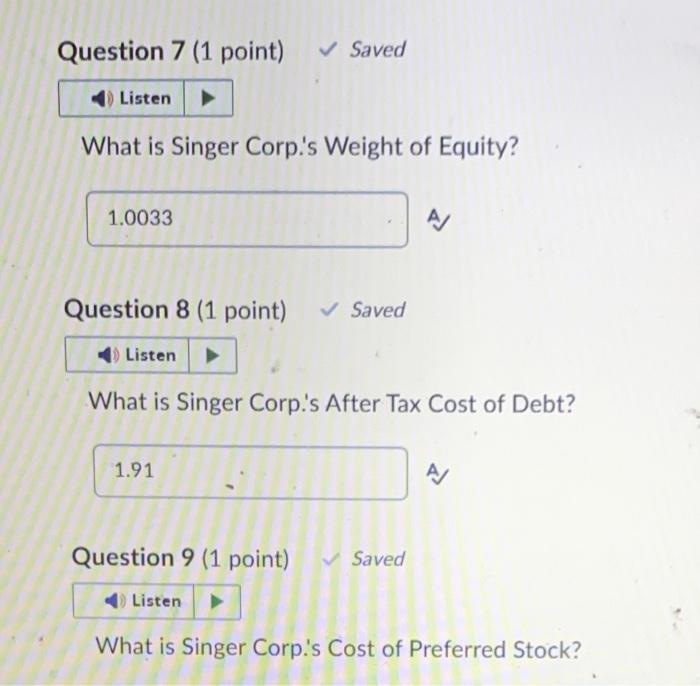

Use the following information about Singer Corp. for problems 7-11. Common stock: 15,000 shares outstanding, $105 per share. Singer will pay a dividend of $2 next year and this dividend is expected to grow at 4% per year. Bonds: 5,000 bonds outstanding, with a 3% coupon paid semiannually, 13 years to maturity, and a bond quote of 105 . Preferred Stock: 1,000 shares outstanding with annual dividends of $3.50, currently selling at $125. Singer Corp.'s marginal tax rate is 25%. What is Singer Corp.'s Weight of Equity? A Question 8 (1 point) What is Singer Corp.'s After Tax Cost of Debt? A Question 9 (1 point) What is Singer Corp.'s Cost of Preferred Stock? Use the following information about Singer Corp. for problems 7-11. Common stock: 15,000 shares outstanding, $105 per share. Singer will pay a dividend of $2 next year and this dividend is expected to grow at 4% per year. Bonds: 5,000 bonds outstanding, with a 3% coupon paid semiannually, 13 years to maturity, and a bond quote of 105 . Preferred Stock: 1,000 shares outstanding with annual dividends of $3.50, currently selling at $125. Singer Corp.'s marginal tax rate is 25%. What is Singer Corp.'s Weight of Equity? A Question 8 (1 point) What is Singer Corp.'s After Tax Cost of Debt? A Question 9 (1 point) What is Singer Corp.'s Cost of Preferred Stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts