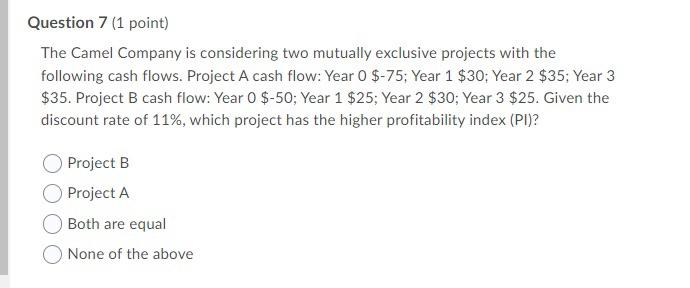

Question: Question 7 (1 point) The Camel Company is considering two mutually exclusive projects with the following cash flows. Project A cash flow: Year 0 $-75;

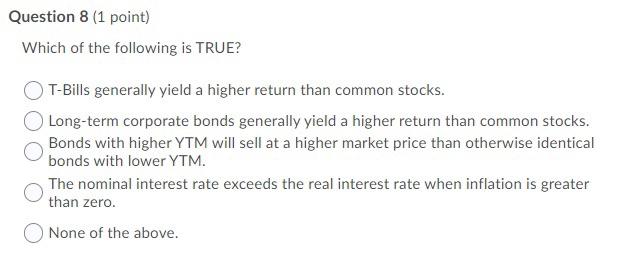

Question 7 (1 point) The Camel Company is considering two mutually exclusive projects with the following cash flows. Project A cash flow: Year 0 $-75; Year 1 $30; Year 2 $35; Year 3 $35. Project B cash flow: Year O $-50; Year 1 $25; Year 2 $30; Year 3 $25. Given the discount rate of 11%, which project has the higher profitability index (PI)? Project B Project A Both are equal None of the above Question 8 (1 point) Which of the following is TRUE? T-Bills generally yield a higher return than common stocks. Long-term corporate bonds generally yield a higher return than common stocks. Bonds with higher YTM will sell at a higher market price than otherwise identical bonds with lower YTM. The nominal interest rate exceeds the real interest rate when inflation is greater than zero. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts