Question: QUESTION 7 1 points Save Answer A municipal bond has yield to maturity of 4.89 percent. A comparable corporate bond has yield to maturity of

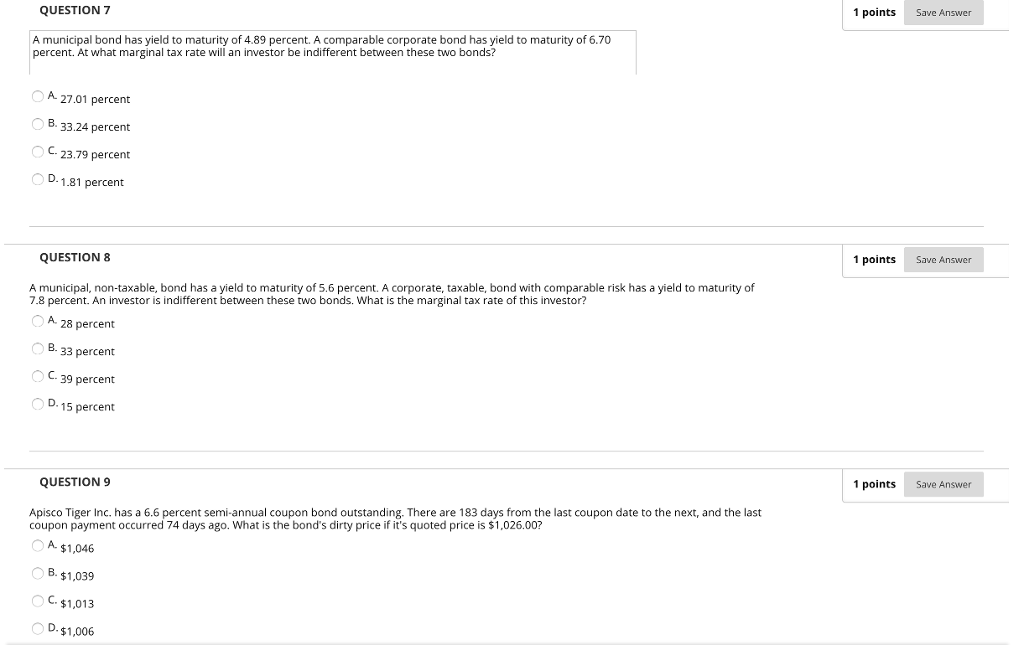

QUESTION 7 1 points Save Answer A municipal bond has yield to maturity of 4.89 percent. A comparable corporate bond has yield to maturity of 6.70 percent. At what marginal tax rate will an investor be indifferent between these two bonds? A 27.01 percent B. 33.24 percent C23.79 percent D. 1.81 percent QUESTION 8 1 points Save Answer A municipal, non-taxable, bond has a yield to maturity of 5.6 percent. A corporate, taxable, bond with comparable risk has a yield to maturity of 7.8 percent. An investor is indifferent between these two bonds. What is the marginal tax rate of this investor? A 28 percent B. 33 percent 39 percent D. 15 percent C. QUESTION 9 1 points Save Answer Apisco Tiger Inc. has a 6.6 percent semi-annual coupon bond outstanding. There are 183 days from the last coupon date to the next, and the last coupon payment occurred 74 days ago. What is the bond's dirty price if it's quoted price is $1,026.00? A $1,046 B. $1,039 . $1,013 D.$1,006

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts