Question: QUESTION 7 1 points Save Answer Assume two securities A and B. The correlation coefficient between these two securities can be written as: O Pa,b

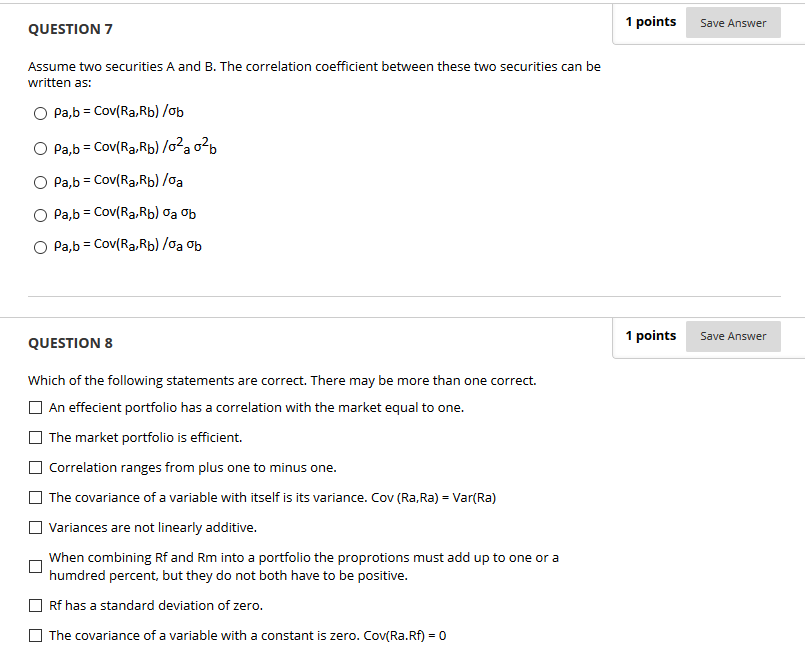

QUESTION 7 1 points Save Answer Assume two securities A and B. The correlation coefficient between these two securities can be written as: O Pa,b = Cov(Ra,Rb) /ob O Pa,b = Cov(Ra,Rb) /02 02b O Pa,b = Cov(Ra,Rb) /Ga O Pa,b = Cov(Ra, Rb) Ta Ob O Pa,b = Cov(Ra,Rb) /Ga Ob QUESTION 8 1 points Save Answer Which of the following statements are correct. There may be more than one correct. An effectent portfolio has a correlation with the market equal to one. The market portfolio is efficient. Correlation ranges from plus one to minus one. The covariance of a variable with itself is its variance. Cov (Ra, Ra) = Var(Ra) Variances are not linearly additive. When combining Rf and Rm into a portfolio the proprotions must add up to one or a humdred percent, but they do not both have to be positive. ORf has a standard deviation of zero. The covariance of a variable with a constant is zero. Cov(Ra.Rf) = 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts