Question: Question 7 1 pts Back to our case study. You are now 45 and approaching your peak earning years. Your earnings have increased to $300,000/year,

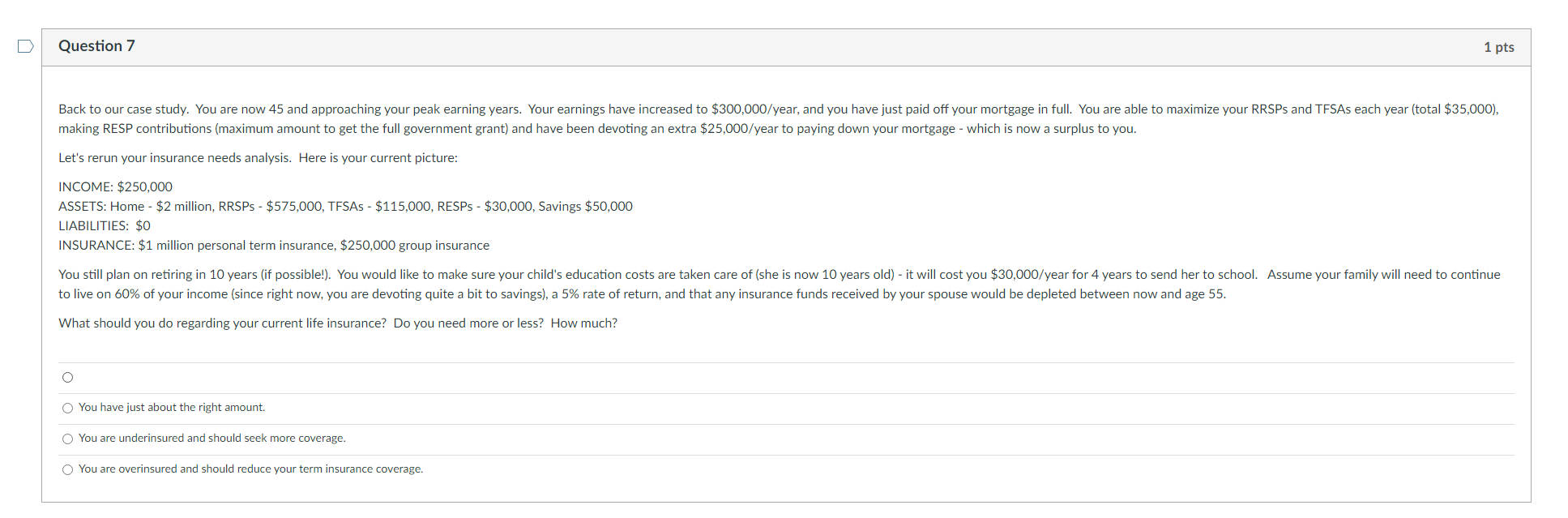

Question 7 1 pts Back to our case study. You are now 45 and approaching your peak earning years. Your earnings have increased to $300,000/year, and you have just paid off your mortgage in full. You are able to maximize your RRSPs and TFSAs each year (total $35,000), making RESP contributions (maximum amount to get the full government grant) and have been devoting an extra $25,000/year to paying down your mortgage - which is now a surplus to you. Let's rerun your insurance needs analysis. Here is your current picture: INCOME: $250,000 ASSETS: Home - $2 million, RRSPs - $575,000, TFSAs - $115,000, RESPs - $30,000, Savings $50,000 LIABILITIES: $0 INSURANCE: $1 million personal term insurance, $250,000 group insurance You still plan on retiring in 10 years (if possible!). You would like to make sure your child's education costs are taken care of (she is now 10 years old) - it will cost you $30,000/year for 4 years to send her to school. Assume your family will need to continue to live on 60% of your income (since right now, you are devoting quite a bit to savings), a 5% rate of return, and that any insurance funds received by your spouse would be depleted between now and age 55. What should you do regarding your current life insurance? Do you need more or less? How much? You have just about the right amount. You are underinsured and should seek more coverage. You are overinsured and should reduce your term insurance coverage. Question 7 1 pts Back to our case study. You are now 45 and approaching your peak earning years. Your earnings have increased to $300,000/year, and you have just paid off your mortgage in full. You are able to maximize your RRSPs and TFSAs each year (total $35,000), making RESP contributions (maximum amount to get the full government grant) and have been devoting an extra $25,000/year to paying down your mortgage - which is now a surplus to you. Let's rerun your insurance needs analysis. Here is your current picture: INCOME: $250,000 ASSETS: Home - $2 million, RRSPs - $575,000, TFSAs - $115,000, RESPs - $30,000, Savings $50,000 LIABILITIES: $0 INSURANCE: $1 million personal term insurance, $250,000 group insurance You still plan on retiring in 10 years (if possible!). You would like to make sure your child's education costs are taken care of (she is now 10 years old) - it will cost you $30,000/year for 4 years to send her to school. Assume your family will need to continue to live on 60% of your income (since right now, you are devoting quite a bit to savings), a 5% rate of return, and that any insurance funds received by your spouse would be depleted between now and age 55. What should you do regarding your current life insurance? Do you need more or less? How much? You have just about the right amount. You are underinsured and should seek more coverage. You are overinsured and should reduce your term insurance coverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts