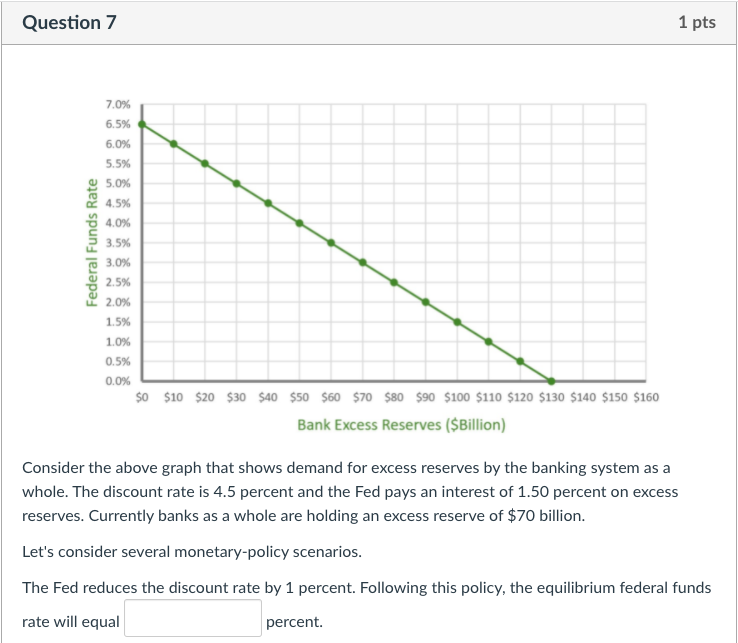

Question: Question 7 1 pts Consider the above graph that shows demand for excess reserves by the banking system as a whole. The discount rate is

Question 7 1 pts Consider the above graph that shows demand for excess reserves by the banking system as a whole. The discount rate is 4.5 percent and the Fed pays an interest of 1.50 percent on excess reserves. Currently banks as a whole are holding an excess reserve of $70 billion. Let's consider several monetary-policy scenarios. The Fed reduces the discount rate by 1 percent. Following this policy, the equilibrium federal funds rate will equal percent. Next, the Fed reduces the discount rate by another 1 percent. Following this second policy action, the equilibrium federal funds rate will equal percent. However, to keep the fed funds rate at this level, the Fed needs to increase the supply of excess reserve in the banking system by billion dollars (say, through an open market purchase). Okay, this scenario rarely happens. So let's move to the next one. Question 7 1 pts Consider the above graph that shows demand for excess reserves by the banking system as a whole. The discount rate is 4.5 percent and the Fed pays an interest of 1.50 percent on excess reserves. Currently banks as a whole are holding an excess reserve of $70 billion. Let's consider several monetary-policy scenarios. The Fed reduces the discount rate by 1 percent. Following this policy, the equilibrium federal funds rate will equal percent. Next, the Fed reduces the discount rate by another 1 percent. Following this second policy action, the equilibrium federal funds rate will equal percent. However, to keep the fed funds rate at this level, the Fed needs to increase the supply of excess reserve in the banking system by billion dollars (say, through an open market purchase). Okay, this scenario rarely happens. So let's move to the next one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts