Question: Question 7 1 pts Two assets, A and B, have identical expected returns -- 5% each -- and standard deviations of 15% and 20%, respectively.

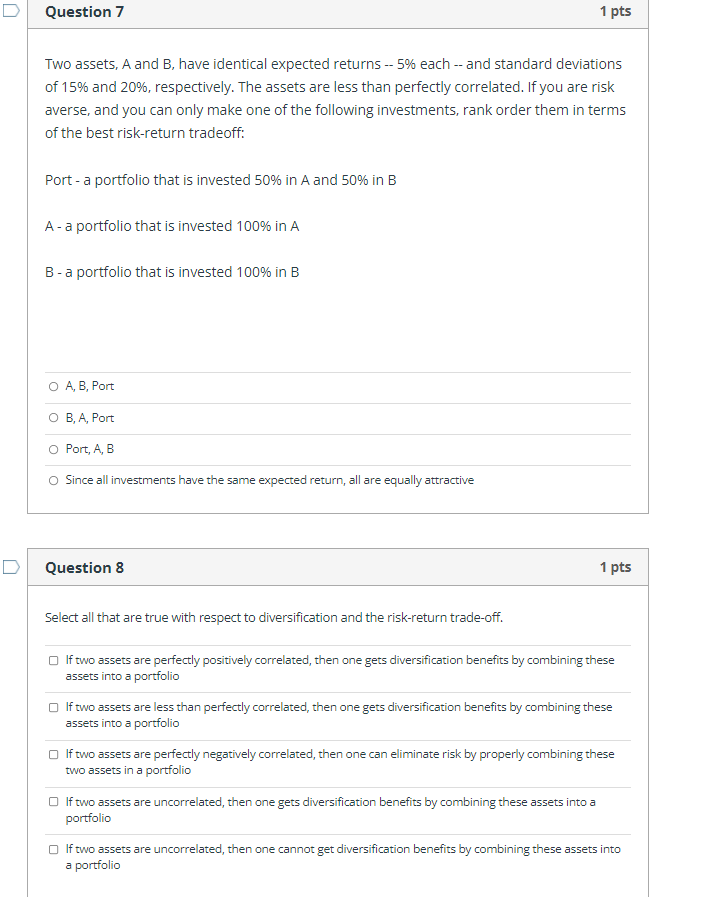

Question 7 1 pts Two assets, A and B, have identical expected returns -- 5% each -- and standard deviations of 15% and 20%, respectively. The assets are less than perfectly correlated. If you are risk averse, and you can only make one of the following investments, rank order them in terms of the best risk-return tradeoff: Port-a portfolio that is invested 50% in A and 50% in B A-a portfolio that is invested 100% in A B-a portfolio that is invested 100% in B O A, B, Port O B, A, Port O Port, A, B O Since all investments have the same expected return, all are equally attractive D Question 8 1 pts Select all that are true with respect to diversification and the risk-return trade-off. If two assets are perfectly positively correlated, then one gets diversification benefits by combining these assets into a portfolio If two assets are less than perfectly correlated, then one gets diversification benefits by combining these assets into a portfolio If two assets are perfectly negatively correlated, then one can eliminate risk by properly combining these two assets in a portfolio If two assets are uncorrelated, then one gets diversification benefits by combining these assets into a portfolio se assets into If two assets are uncorrelated, then one cannot get diversification benefits by combining a portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts