Question: Two assets, A and B, have identical expected returns -- 5% each -- and standard deviations of 15% and 20%, respectively. The assets are less

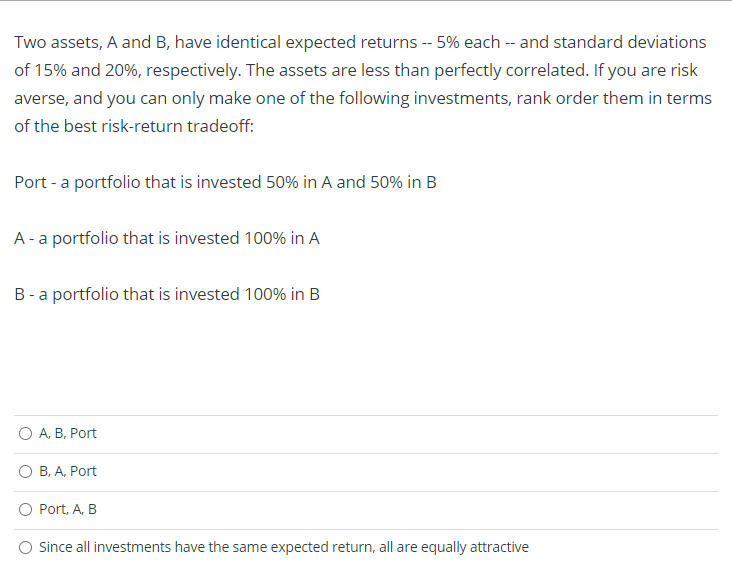

Two assets, A and B, have identical expected returns -- 5% each -- and standard deviations of 15% and 20%, respectively. The assets are less than perfectly correlated. If you are risk averse, and you can only make one of the following investments, rank order them in terms of the best risk-return tradeoff: Port-a portfolio that is invested 50% in A and 50% in B A- a portfolio that is invested 100% in A B-a portfolio that is invested 100% in B O A, B, Port O B, A, Port O Port, A, B Since all investments have the same expected return, all are equally attractive

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock