Question: QUESTION 7 10 points Save Answer Suppose you borrow 100 dollars to buy one share of a stock today (the stock price (SO) is $100),

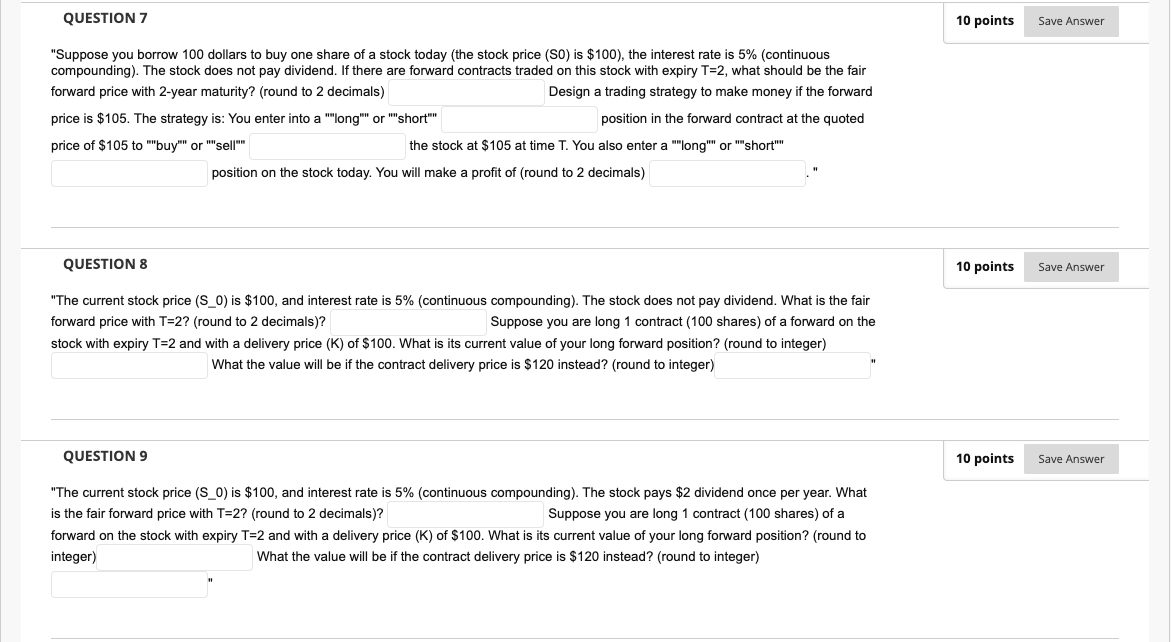

QUESTION 7 10 points Save Answer "Suppose you borrow 100 dollars to buy one share of a stock today (the stock price (SO) is $100), the interest rate is 5% (continuous compounding). The stock does not pay dividend. If there are forward contracts traded on this stock with expiry T=2, what should be the fair forward price with 2-year maturity? (round to 2 decimals) Design a trading strategy to make money if the forward price is $105. The strategy is: You enter into a "long" or ""short position in the forward contract at the quoted price of $105 to "buy" or "sell the stock at $105 at time T. You also enter a long" or "short" position on the stock today. You will make a profit of (round to 2 decimals) QUESTION 8 10 points Save Answer "The current stock price (S_O) is $100, and interest rate is 5% (continuous compounding). The stock does not pay dividend. What i the fair forward price with T=2? (round to 2 decimals)? Suppose you are long 1 contract (100 shares) of a forward on the stock with expiry T=2 and with a delivery price (K) of $100. What is its current value of your long forward position? (round to integer) What the value will be if the contract delivery price is $120 instead? (round to integer) QUESTION 9 10 points Save Answer "The current stock price (S_O) is $100, and interest rate is 5% (continuous compounding). The stock pays $2 dividend once per year. What is the fair forward price with T=2? (round to 2 decimals)? Suppose you are long 1 contract (100 shares) of a forward on the stock with expiry T=2 and with a delivery price (K) of $100. What is its current value of your long forward position? (round to integer) What the value will be if the contract delivery price is $120 instead? (round to integer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts